Stablecoins and Why They Matter

What are stablecoins and why are they important? I get asked these two questions quite a lot, especially by those who are new to the world of crypto.

What are stablecoins, and why do they matter? I get asked these two questions quite a lot, especially by those who are new to the world of crypto.

Stablecoins are tokens that are pegged to real-world currencies, hence the name stable+coin. The stablecoin Tether (USDT), for instance, is pegged to the US dollar, meaning USDT 1 is worth $1 and will (should) always remain that way. The peg is maintained by the issuing company, which ensures that for every stablecoin in circulation, an equivalent amount of US dollars are held in their treasury.

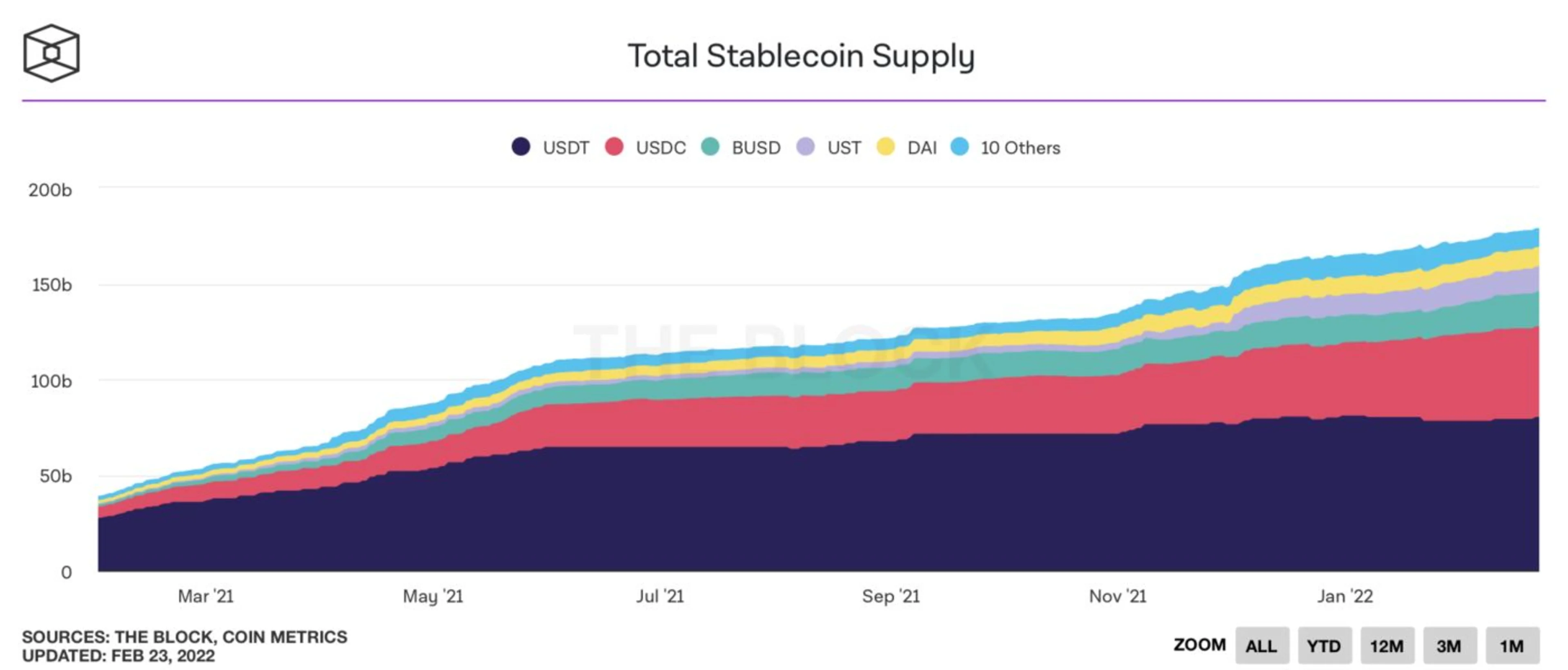

Stablecoins are massive, and their adoption is expanding rapidly. The total market capitalization of stablecoins is estimated to be nearly $200 billion, up from nearly $40 billion last year! In the past year along, USDT, the most popular stablecoin by market cap, increased from $46 billion to $82 billion. USD Coin (USDC), the second-largest stablecoin, increased its market cap from $11 billion to 50 billion dollars. All this is happening during a year when the crypto market, in general, has been flat. It is worth noting that both USDT and USDC are available on CoinMENA.

So, why are stablecoins important? In short, they deliver all the benefits of crypto – such as mobility, accessibility, convenience, and low-cost transfers – without any of the associated volatility. They also act as a useful bridge between traditional finance and DeFi, providing a convenient entry point into the world of crypto while representing an effective tool for anyone looking to transfer funds internationally.

Currently, if we want to transfer money internationally, the banks use the SWIFT system. Which technically is just a secure messaging service between banks. SWIFT was invented in 1973 and still remains the most popular method of transferring funds between two parties to this day.

However, anyone who has transferred money internationally before will be aware of how much hassle is involved, owing to the outdated and cumbersome systems that are employed. Sending money via stablecoins such as USDT and USDC, on the other hand, is as easy as sending an email, offering a far more streamlined and efficient experience for users.

To give an example of just how cost-effective they can be, CoinMENA recently introduced a new feature that enables users to withdraw USDT via the TRON TRC20 network for a fixed fee of just $3 – regardless of the volume in question.

This is why so many financial institutions – SWIFT included – are investing in their own blockchain initiatives. Just like sending an email is better and faster than sending a letter via mail, transferring money through crypto is exponentially more efficient. The market is realizing this and is simply migrating to a better user experience.