𝗣𝗲𝗿𝘀𝗽𝗲𝗰𝘁𝗶𝘃𝗲 𝗶𝘀 𝗲𝘃𝗲𝗿𝘆𝘁𝗵𝗶𝗻𝗴!

What we’re seeing in the markets right now is undeniably unsettling.

What we’re seeing in the markets right now is undeniably unsettling. Equity indices are down sharply, bonds are underperforming, and the headlines are filled with tariffs (increasing, then paused—then increasing again, then paused again), trade wars, and geopolitical tensions. But as difficult as this moment feels, it’s important to remember: 𝗳𝗲𝗮𝗿 𝗶𝘀 𝗻𝗼𝘁 𝗮 𝘀𝘁𝗿𝗮𝘁𝗲𝗴𝘆.

We saw this play out during the COVID crash. The market panic led to one of the fastest sell-offs in history! Yet it turned out to be one of the best buying opportunities of the decade. Why? Because deep down, we knew the world wasn’t going to stay shut down forever.

Today’s crisis is more complicated.

It’s not a pandemic. It’s a global economic realignment. The U.S. appears to be done with being the world's consumer of last resort. By imposing sweeping tariffs, it’s signaling a desire to re-shore manufacturing and reset decades of trade policy. Will it work? Time will tell, but for now, they announced a 90-day pause after the bond market was flashing massive RED alarm bells as the 10Y yield was spiking.

But what’s already clear is this: U.S. markets are no longer the safe, “risk-free” destination they once were.

In a world of multipolar trade conflicts, understanding counterparty risk is critical. The old assumptions about Treasuries, about the S&P 500, are no longer sacred.

Historically, in times like these, capital flows into neutral assets, gold, and now, increasingly, Bitcoin.

And despite the market turbulence, Bitcoin is holding strong. It only crossed $74K for the first time six months ago. Today, it’s still trading above the all-time high reached in November after Trump’s election, even as U.S. stocks log one of their worst weeks in history. Over the past 6 months, bitcoin is up 33%, while the Nasdaq is down 6%!

For those who understand Bitcoin’s unique properties- scarcity, neutrality, no counterparty risk- this isn’t just a moment of stress. It’s a moment of clarity. Yes, this transition is painful. But it’s also revealing. For long-term investors, it could turn out to be a once-in-a-lifetime opportunity.

Invest in the future of finance today with CoinMENA

Related Articles

Tariff Wars & Bitcoin's Role in New Economic World Order

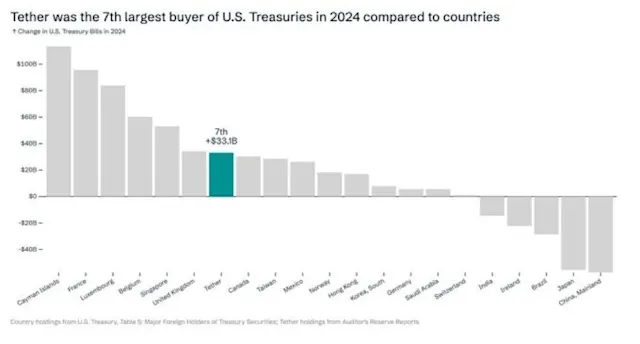

How Tether became the 7th largest buyer of US treasuries in 2024

The U.S. Just Took a Monumental Step Toward Bitcoin Adoption