The U.S. Just Took a Monumental Step Toward Bitcoin Adoption

The 2025 Bitcoin reserve for the US government that will reshape the global financial landscape.

This will go down in history as a milestone like the Fed creation in 1913 or the "Nixon Shock" in 1971 when the US ended dollar convertibility to gold and implemented wage and price controls.

The 2025 Bitcoin reserve for the US government that will reshape the global financial landscape. President Trump signed an executive order establishing a Strategic Bitcoin Reserve and a United States Digital Asset Stockpile. Importantly, they’ve clearly separated Bitcoin from other digital assets, and for good reason.

Bitcoin is the only truly neutral, decentralized, and issuer-less asset in existence. It’s digital gold, and the U.S. government recognizes this. Under the new order, the U.S. will not sell any of its current Bitcoin holdings (acquired through past seizures) and will explore “budget-neutral” ways to acquire more. (Yes, you read that right – a government with $36 trillion in debt is suddenly worried about budget neutrality. The irony isn’t lost on me.) As for other digital assets, the approach is different. The U.S. won’t buy more but may sell its existing stockpile. While I believe other digital assets have a role to play in the future of finance, they simply don’t belong in a strategic reserve.

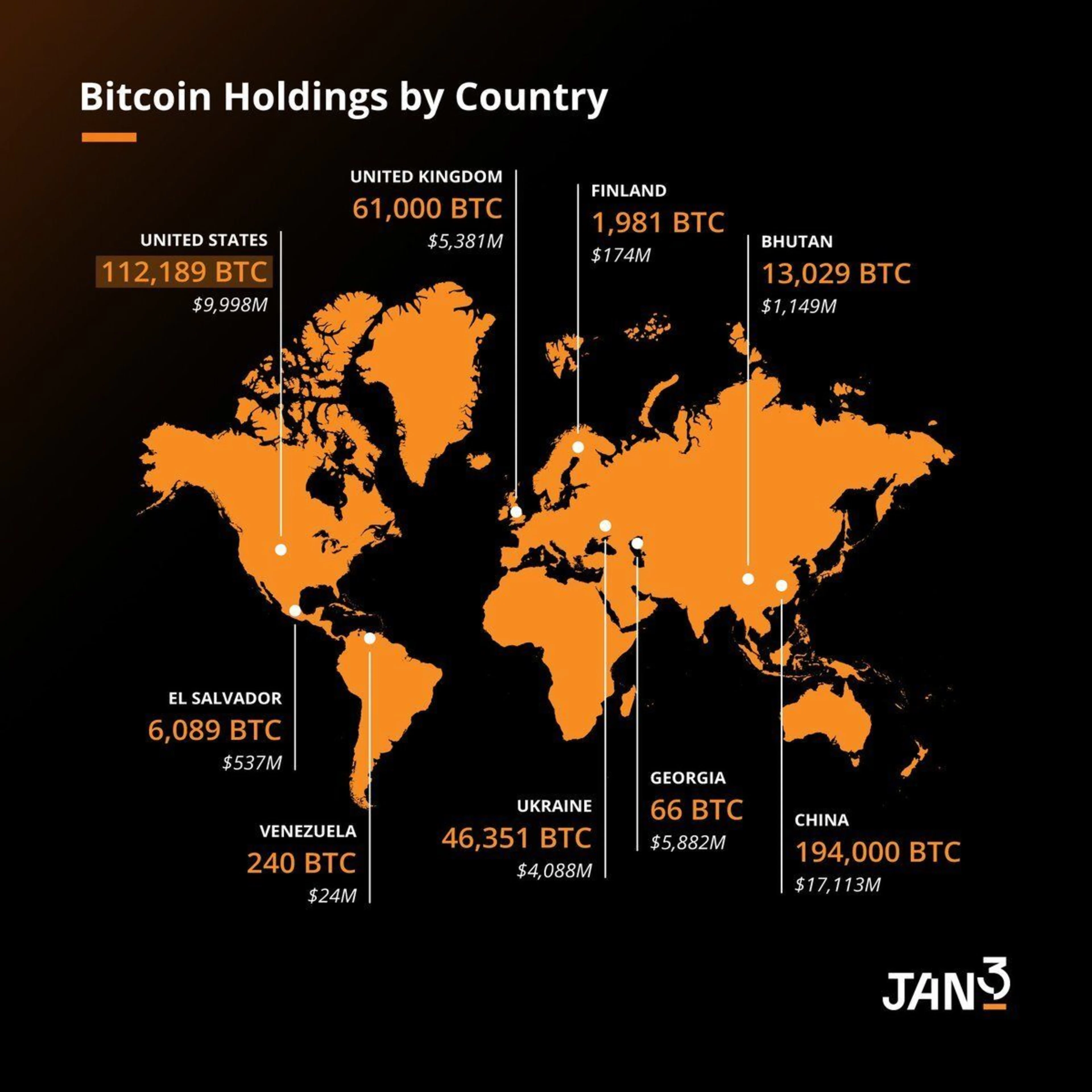

This move is a game-changer. Right now, China holds more Bitcoin than the U.S., but that’s about to change. The U.S. is gearing up for a Bitcoin arms race, and nations that act quickly will reap the most benefits. The “early adopter” window is closing fast, and those who hesitate will be left behind.

The U.S. has laid down the blueprint. Bitcoin is no longer a speculative asset; it’s a strategic reserve asset for nations. The UAE has already taken a pioneering step as the first Arab nation to publicly disclose a Bitcoin position through BlackRock’s IBIT ETF. However, Bitcoin’s true superpower lies in its ability to be self or locally custodied, reducing counterparty risk. This is what makes it an ideal strategic reserve for nations. Political alliances can shift, and relying on third parties for custody introduces vulnerabilities. Every nation must have full control over its strategic reserves to ensure sovereignty and security.

The time to act is now. Whether you’re influencing national budgets, investment strategies, or economic policy, I implore you to seriously consider studying Bitcoin. The first movers will secure a competitive advantage for decades to come.

Read the full executive order here: Establishment of the Strategic Bitcoin Reserve