How Tether became the 7th largest buyer of US treasuries in 2024

For years, Tether was unjustly a target of FUD attacks and branded as an “offshore, unregulated, a ticking time bomb.”

For years, Tether was unjustly a target of FUD attacks and branded as an “offshore, unregulated, a ticking time bomb.” Now, it’s a key player in extending U.S. dollar hegemony, with over 350 million users, and doing more to bank the unbanked than any bank on a global scale. How? Network effects.

Network Effects (noun): A phenomenon where the value of a product or service increases as more users adopt it, creating a positive feedback loop.

Tether has mastered this. It’s the most profitable company per employee, generating almost $14 billion in profit in 2024, surpassing BlackRock over the same period! Their business model? Simple:

Buy U.S. Treasuries > Sell USDT for dollars > Pocket the yield

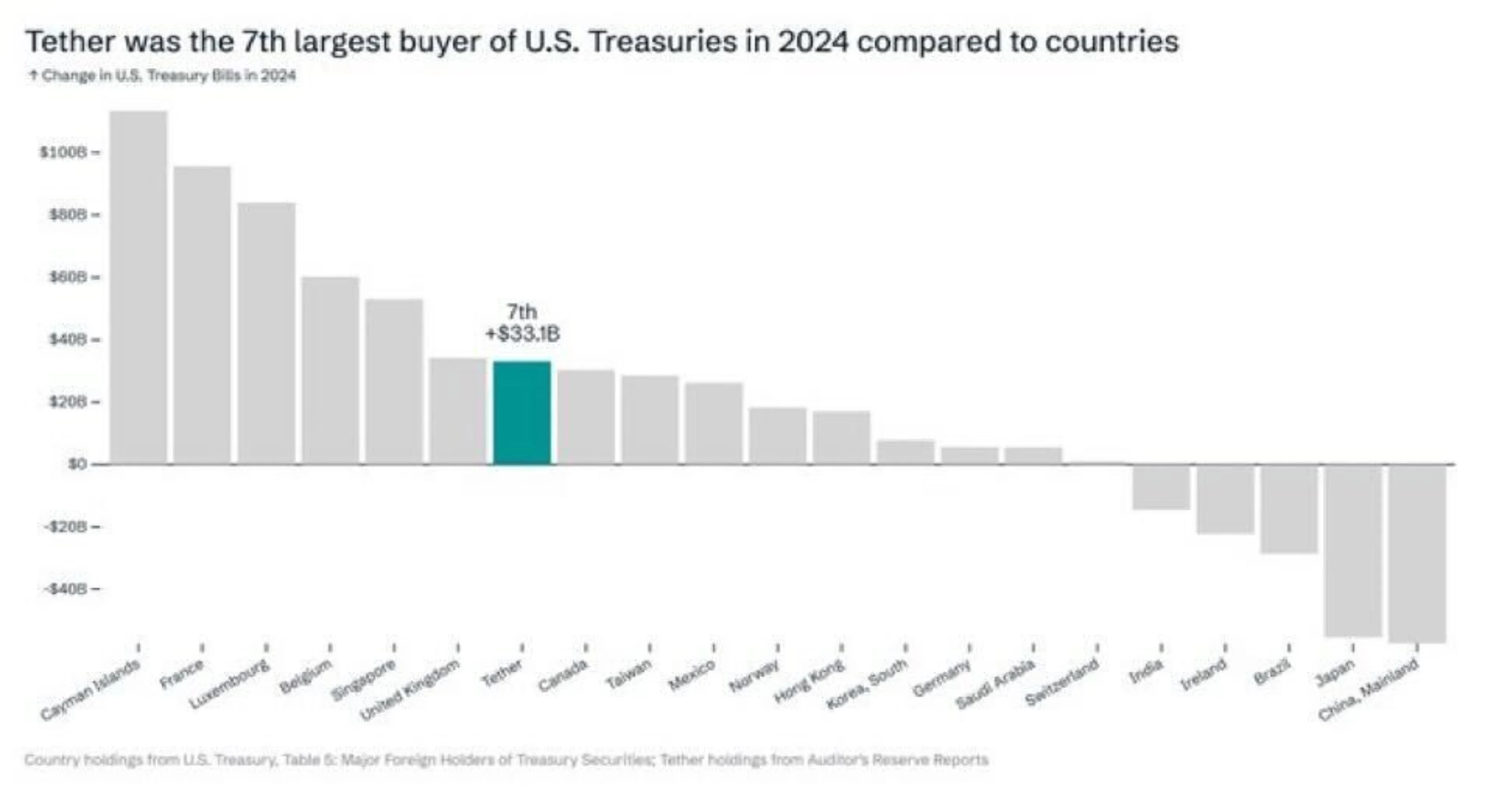

In fact, Tether has become such a dominant buyer of U.S. Treasuries that in 2024, it ranked as the 7th largest holder worldwide, outpacing entire countries like Canada, Norway, and Saudi Arabia.

If it is so “simple”, why hasn't anyone copied this insanely profitable business?

Many have tried. Some of the biggest companies in crypto have launched stablecoins, mostly U.S.-based, even Trump has just launched one! But here’s the key issue: There’s no shortage of dollars in the U.S. The real demand for USDT comes from outside the U.S., where access to relatively “stable” currencies is scarce.

Most people focus on Tether’s digital distribution, USDT runs on multiple blockchains and is available across major platforms. But what’s often overlooked is its physical distribution network.

Across the developing world, Africa, South America, and Asia, physical kiosks sell USDT like a foreign exchange service. Tether understood its product: dollars outside the U.S.

Around the world, fiat currencies are collapsing. In many countries, only high-net-worth individuals can open dollar accounts, or make/receive payments in dollars. Even then, their money is at risk, governments can enforce capital controls or outright freeze bank accounts overnight, just like what happened in Lebanon.

For millions, USDT in a digital wallet is the new Swiss private bank, but better. It’s in your pocket, free from local counterparty risk, empowering individuals to control their financial future.

While critics reduce crypto to “just” speculation, its real-world utility emerges when currencies collapse or hyperinflate. When people must flee war, authoritarian regimes, or economic disaster, assets like USDT and Bitcoin, in self-custody, allow people to carry their wealth with them wherever they go. This use case alone makes Bitcoin and USDT one of the most important innovations in history, as we cannot even imagine the applications that will be built on top of this infrastructure.

With pretty much every tech and financial company looking to launch or use stablecoins, I'd imagine growth will continue to skyrocket as stablecoins is clearly how we solve financial inclusion globally for individuals and companies.