Bitcoin Adoption is Moving Faster Than You Think

In just 15 years, Bitcoin has grown from zero to a $1.4 trillion asset class without a CEO, Corporate register, marketing department, or a PR team!

Understanding Bitcoin can be challenging because it represents a paradigm shift. People often try to relate it to something familiar, which is natural. The closest comparison is the Internet's TCP/IP protocol. Did you know that TCP/IP was developed in the 1970s and adopted as the standard for ARPANET (the predecessor to the Internet) in 1983? It took almost 30 years before the Internet saw mass adoption in the late 1990s and early 2000s. Now, compare this to Bitcoin, which was introduced by Satoshi Nakamoto in 2009. In just 15 years, Bitcoin has grown from zero to a $1.4 trillion asset class without a CEO, Corporate register, marketing department, or a PR team!

For skeptics questioning why Bitcoin adoption hasn't "taken off," I have two responses:

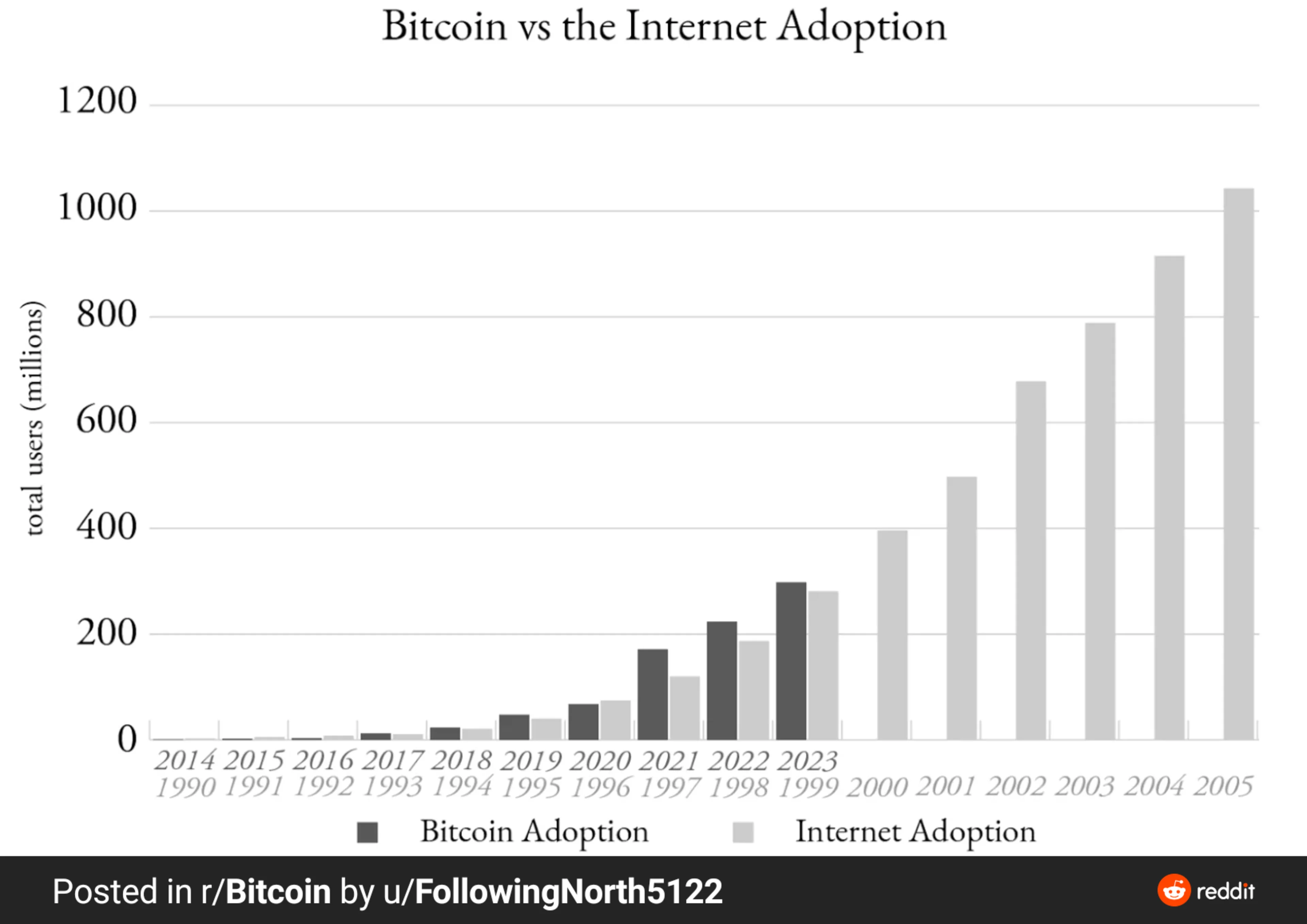

1) It is! The price has been appreciating at an annualized rate of 150% since 2011, and the number of users is increasing at a faster rate than internet adoption (see chart)

2) Regulating crypto was not straightforward. Is it regulated as a security or commodity? Does it fall under the remit of central banks? It took time to figure everything out but now you have a Bitcoin and Ethereum ETF and clear crypto regulations across every continent.

Additionally, several factors influence Bitcoin's adoption pace:

Technological Understanding and Trust: Similar to how the internet requires time for people to understand and trust (I remember when people were scared to buy anything online), Bitcoin needs a period for widespread comprehension and confidence in its potential.

Regulatory Environment: Bitcoin operates within a complex regulatory landscape, which can either accelerate or slow its adoption depending on the region and prevailing attitudes toward cryptocurrencies.

Network Effects: Bitcoin's adoption benefits from network effects. As more people use and accept Bitcoin, its utility and value increase, encouraging further adoption.

Economic Environment: Bitcoin's appeal as a hedge against inflation and currency devaluation is becoming more evident in the current macroeconomic climate, where every fiat currency in the world is losing purchasing power, including the U.S. dollar, which has lost 25% of its purchasing power in the past four years alone (aggregate inflation).

The flight to quality, as Larry Fink (BlackRock CEO) puts it, is a shift of capital towards more scarce assets. Investors and savers have several ways to avoid the falling dollar knife, such as real estate, commodities, or gold—scarce assets. However, Bitcoin is the fastest horse in this race because it is objectively the most scarce monetary asset in the world.

If you are in MENA, you can buy bitcoin in your local currency right now at www.coinmena.com.