It's time for plan B

"Fiat” money's utility as a store of value is rapidly deteriorating, and I'm not only talking about Pesos or Liras.

"Fiat” money's utility as a store of value is rapidly deteriorating, and I'm not only talking about Pesos or Liras.

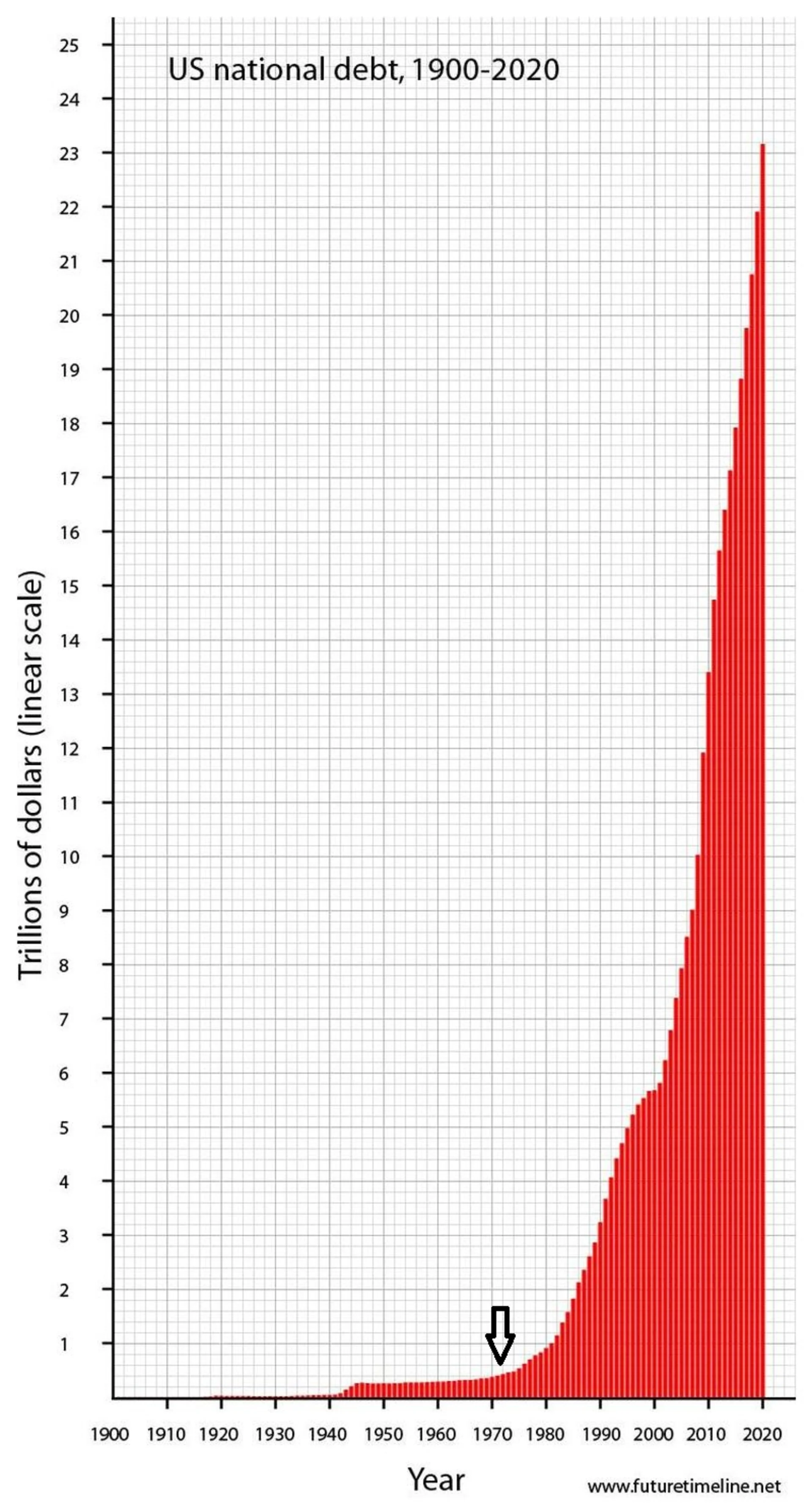

In 1971, the U.S. decided to abandon the gold standards and establish the dollar as the global reserve currency. This move essentially gave the US Federal Reserve Bank, the ability to create money without the need to back it up with any reserves (previously gold). As the saying goes “absolute power corrupts, absolutely”. Since then money supply through debt creation has increased exponentially. In 1971 the US had less than 1 trillion dollars in debt, today that figure is 31.7 trillion dollars!

Fast forward to today, central banks embarked on the fastest interest rate hike in history to tame 40-year high inflation. This contraction in liquidity is proving too much for the system to handle, as several banks are now struggling to meet their liquidity obligations to their customers. Currently, U.S. banks are sitting on ~$600 billion in unrealized losses. If they’re forced to sell and actualize these losses, it will likely cause a severe banking crisis. In response, last week the Fed pumped ~$300 billion into the economy, that's HALF of the liquidity they sucked out of the system over the past 12 months in just one week!

So what are central bankers going to do? I can see two possible outcomes:

A) Continue hiking interest rates and risk a recession: this can expose depositors in banks to counterparty risks as there isn't enough liquid assets on hand for banks to honor customer withdrawals

B) Print money (again) in some form and debase the currency resulting in persistent high inflation. Some smart people are even calling hyperinflation around the corner.

Regardless of what happens, I think the era of fiat money printed out of thin air is due for an overhaul. Investors need a hard money alternative to save their purchasing power. For the majority of the world, buying gold is not as feasible because of the difficulties in verifying its authenticity, transporting, and custody-ing it. The same goes with other commodities, you end up buying a paper claim on the commodity, where you still have to trust a third party to honor your claim. Real estate of course is a solid hard asset but it's prohibitive for the majority of people because its not as easy to just buy $100 of real estate. Bitcoin, however, the first absolutely scarce digital bearer asset offers a solution.

Bitcoin has a fixed / predictable supply, so it's perfectly inelastic and doesn't change based on price or demand. It is a digital bearer asset, which means you can self custody it easily on a mobile phone with no counterparty risk. When you buy bitcoin, you’re not buying a claim on bitcoin, you’re buying the asset itself. It is by all measures a superior savings technology that is badly needed in this digital age.

Its time for plan B. The world is waking up to the fact that the risk of not owning bitcoin is greater than the risk of holding it. What a time to be alive.