Fractional Reserve Banking

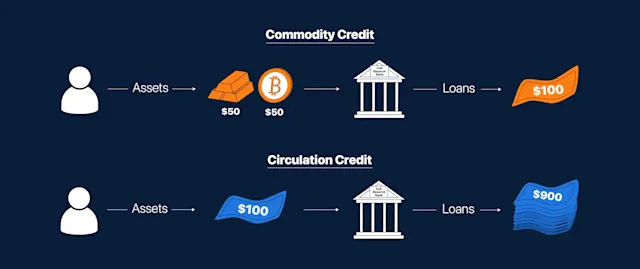

Fractional reserve banking is a system in which banks are only required to have a fraction of bank deposits from their customers backed by actual cash on hand or available for withdrawal.

Fractional reserve banking is a system in which banks are only required to have a fraction of bank deposits from their customers backed by actual cash on hand or available for withdrawal. This is done to expand the economy by enabling banks to free idle capital for commercial lending while keeping a sufficient amount for customer withdrawals.

The creation of the fractional reserve?

The fractional reserve system was first established by the Swedish Riksbank in 1668 after establishing the first central bank in the world. The idea came about after banks realized that there is a minimal chance that all the customers would come to claim their money from the bank at once; therefore, instead of hoarding the money in a vault, it could be used to grow and expand the economy through commercial loans. Fractional reserve banking became more popular around the world after the U.S. enacted The Federal Reserve Act of 1913, which created the Federal Reserve Bank, now known as the U.S. Central bank.

How does it work?

When a customer deposits money into their bank account, the money is no longer directly theirs. The bank holds custody of the customer deposits, and they provide the customer with a deposit account that they can withdraw their money from upon demand.

The bank now has full control of the money as the custodian. The bank can opt to reserve a small percentage of the deposited amount (fractional reserve) and loan the rest or use it for another commercial purpose. The reserve amount usually ranges between 3% to 10%. Although, during harsh economic times, the central banks can lower this reserve requirement to 0%. The Covid-19 pandemic forced central banks around the world to lower the reserve requirement to help stimulate the economy.

Example

Customer A deposits 100,000 AED in Bank 1. Bank 1 loans Customer B 90,000 AED

Customer B deposits 90,000 AED in Bank 2. Bank 2 loans Customer C 81,000 AED

Customer C deposits 81,000 AED in Bank 3. Bank 3 loans Customer D 72,900 AED

Customer D deposits 72,900 AED in Bank 4. Bank 4 loans Customer E 65,610 AED

Customer E deposits 65,610 AED in Bank 5. Bank 5 loans Customer F 59,049 AED

As you can see, the original amount of 100,000 AED has been expanded to represent deposited money for five accounts, and the total existing money supply is 468,559 AED, including the final loan. This is a basic representation of the money multiplier effect.

The system works on the basic principles of debt. The money deposited into the bank by a customer is considered a debt (liability) on the bank to the customer and an asset for the customer. The banks then loan out this money with an interest rate to make a profit for themselves and have the principal amount to pay back their original debt to the depositor (customer).

Pros & Cons of fractional reserve

Banks have the most benefit from a fractional reserve system as this is the way they make their profits. Additionally, customers can also earn interest through their savings or deposit account paid from the interest profits made by the bank. Governments also support this system because it encourages spending and provides economic stability and growth.

Economists from the Austrian School of economics argue that this system is unsustainable and risky given that most countries rely on a credit-based system and not hard money. Additionally, a fractional reserve system runs the risk of a bank run. Essentially, if people lose faith in a bank to be able to pay back all the depositor’s money, it would trigger a “run on the banks” or “bank run.” It is not typical behavior for customers to go claim their money from the bank all at once, but it has happened in the past, with the most notorious example being the 1929 Great Depression in the U.S. In this case, the banks would only be able to pay out only 3% of depositors, equal to the fractional reserve requirement.