What Happened After 1971? (Part 2)

What happened after 1971? (Part 2)

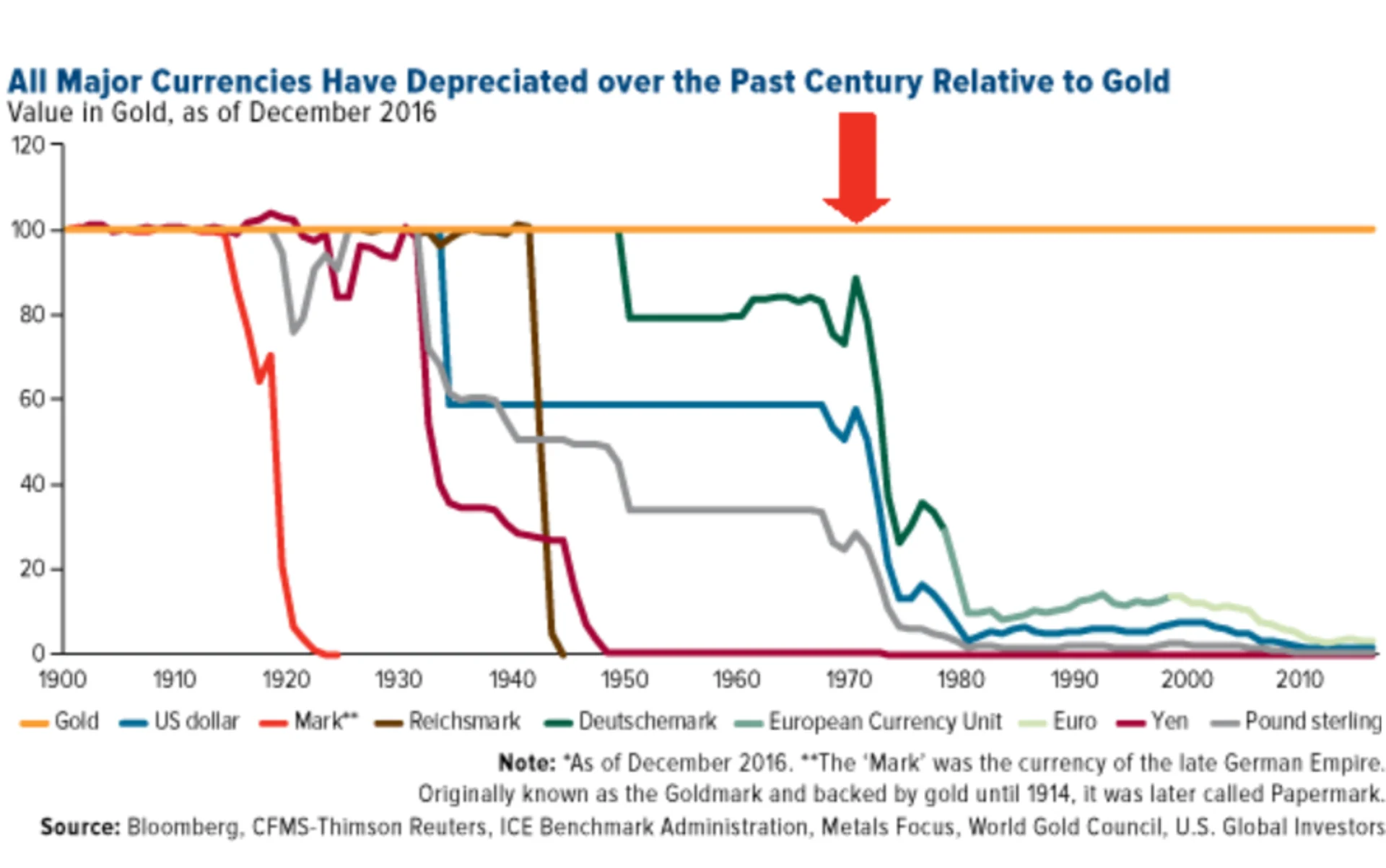

When President Nixon decided to take the dollar off the gold standard, gold indirectly had no role in the monetary system for the first time in the history of the world. The so-called “temporary suspension” still stands 51 years down the line proving not to be a temporary measure, as central banks have not wanted to give up the power they tasted with the fiat system.

After the breakaway from the Bretton Woods system (gold standard), a “Fiat Currency System” was created,” fiat being a Latin term that translates to “let it be”; thus, the new currency system was built on trust and stability of the issuing government with no intrinsic behind it.

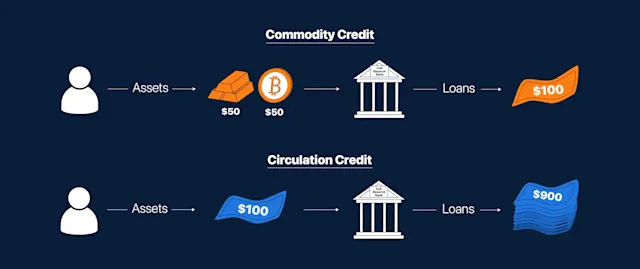

The introduction of a fiat system went hand in hand with the fractional reserve banking system. Banks can create money out of thin air through the expansion of credit. With a low reserve requirement of just 10% or less, the monetary supply expands at the will of the banks. This has enabled the M2 money supply to expand exponentially globally as banks continue to provide more commercial loans and take risks by investing in the market to make a profit.

Since then, the dollar has devalued, losing its peg of $35 per ounce, and 51 years down the line, the price of gold stands at around $1946 (at the time of writing). The USD has been one of the better currencies as currencies belonging to the G7 members (strongest economic countries in the world) have experienced far worse inflation, not to mention the high inflation to hyperinflation faced by countries such as Zimbabwe, Venezuela, and more recently Turkey.

Source: https://wtfhappenedin1971.com/

Moreover, this led to the rise of capitalist policies that have deregulated the market, thus decreasing oversight and enabling market participants to take more leveraged trades. The opportunities have led to a new industry of speculators and risk managers that have made derivative trading and long-term betting common.

The frequency of economic crises has increased since the adoption of a flexible exchange rate system in which currency exchange and trade have been left entirely to market forces. Without the discipline of gold, governments and central banks have continued to print money as they please, be it to fund military expenditure, excessive social programs, and institutional bailouts by governments & central banks have become a norm.

1971 to the present day: The Nixon Shock to the Rise of Cryptocurrency

The Nixon shock took us off the gold standard and put us on the fiat standard. After the 2008 economic recession, the extensive risks taken by central banks were exposed, and trust was lost in the system. The first cryptocurrency Bitcoin was created as a hedge against the profligacy of central banks; a currency that is fully transparent, decentralized, and has a fixed supply was viewed by Satoshi Nakamoto as the solution to the monopoly that centralized entities such as central banks and governments have over monetary policy through the fiat system. It is colloquially referred to as “digital gold” with the added benefits of digitization to provide ease of translatability, divisibility, storage, and transparency over gold and fiat currencies.