KC #149:UAE expands crypto investments & favorable regulations from the U.S.

Ahlan wa sahlan, and welcome to the 149th edition of CoinMENA’s weekly newsletter, Kalam Crypto!

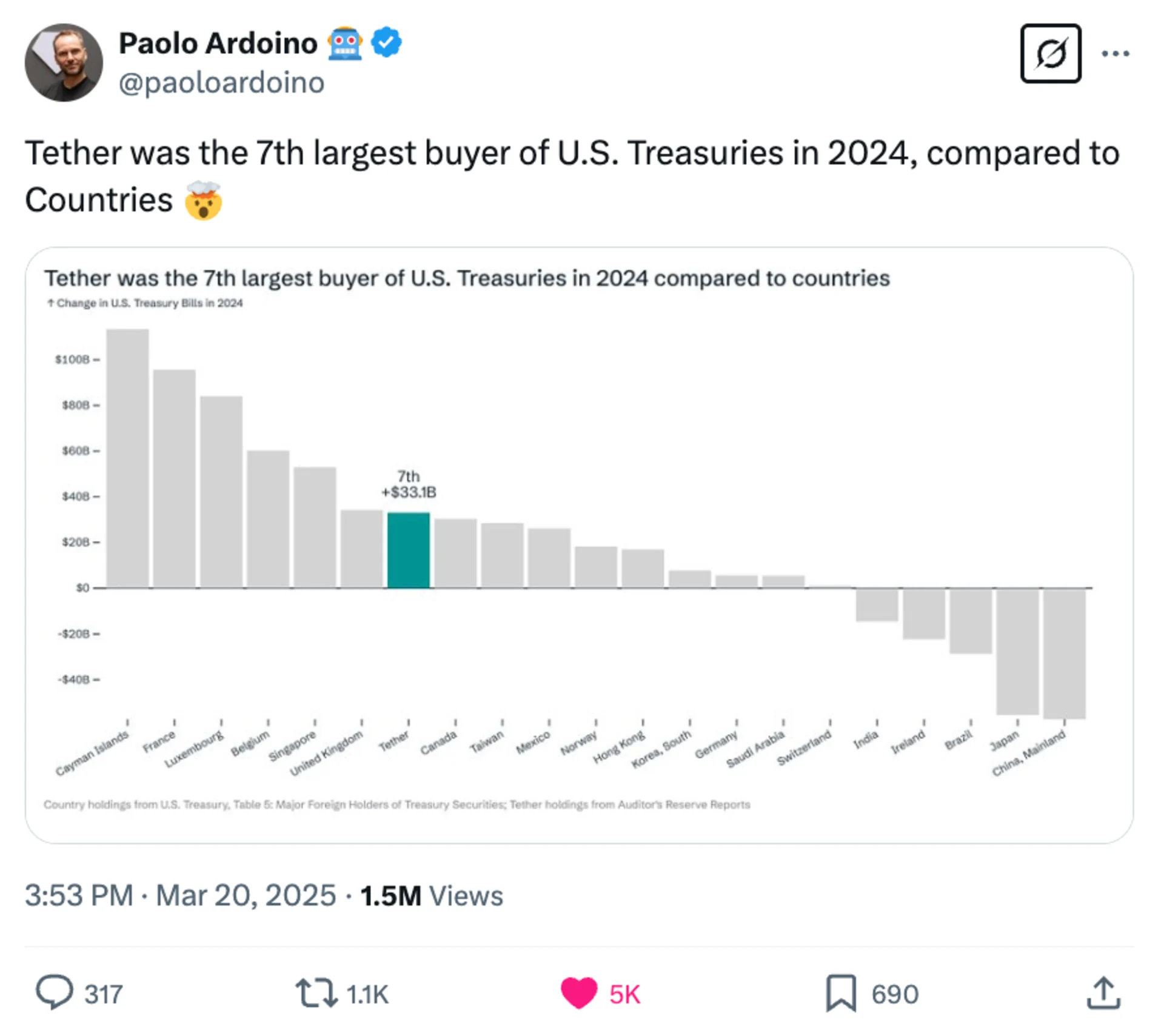

"Tether is eating central banks other than the Fed, because it does what they do—issue money backed by dollars & T-bills—in a far cheaper and more efficient way." Dr. Saifedean Ammous

Ahlan wa sahlan, and welcome to the 149th edition of CoinMENA’s weekly newsletter, Kalam Crypto!

This week, the UAE deepens its crypto investments while strengthening collaboration with the U.S., Trump signals stronger support for digital assets, and favorable regulatory updates continue to emerge from the U.S. Meanwhile, corporate Bitcoin stacking accelerates as Strategy, Metaplanet, and Rumble add to their holdings, Russia turns to crypto for oil trade with China, and Pakistan takes steps to legalize digital assets.

All this and more in this week’s Kalam Crypto!

Local News 📍

UAE Expands Crypto Investments Amid Growing U.S. Collaboration

The UAE continues to solidify its position as a global leader in digital assets, underscored by a recent high-profile visit to Washington, D.C. Sheikh Tahnoon bin Zayed Al Nahyan, the UAE’s National Security Advisor, met with U.S. leaders, including President Trump and crypto advisor David Sacks, to discuss AI and blockchain cooperation. The visit coincided with the announcement of a $1.4 trillion, 10-year U.S.-UAE investment framework, reinforcing the strategic role of digital assets in future economic ties.

This comes as UAE investment firm MGX, chaired by Sheikh Tahnoon, committed $2 billion to Binance earlier this month, further demonstrating the country’s increasing stake in the crypto industry. Meanwhile, the U.S. has taken a historic step by establishing a Strategic Bitcoin Reserve, a move that could influence global policy. The UAE, through its sovereign wealth fund Mubadala, already holds nearly half a billion dollars in IBIT shares (BlackRock’s Bitcoin ETF). Will they consider increasing their exposure by establishing a strategic Bitcoin reserve for the UAE?

Global News 🌍

Trump Signals Strong Support for Crypto

President Donald Trump made a virtual appearance at the Blockworks Digital Asset Summit (DAS) on Thursday, declaring that the U.S. will “dominate crypto and the next generation of financial technologies.” He also highlighted steps his administration had taken to support the industry.

Adding to the wave of positive regulatory news, the SEC is reportedly set to drop its case against Ripple, fueling an 11% surge in XRP. While the decision still requires SEC Commission approval, Ripple CEO Brad Garlinghouse framed it as a major win for the crypto industry.

Meanwhile, the U.S. Treasury removed Tornado Cash smart contracts from its sanctions list, easing restrictions on individual users while maintaining scrutiny of illicit activity.

In another key development, the SEC’s Division of Corporation Finance clarified that proof-of-work crypto mining does not fall under U.S. securities laws, even when miners earn rewards through centralized pools. This applies to “Covered Crypto Assets” like Bitcoin, reinforcing its regulatory distinction from securities.

Trump’s World Liberty Launches Stablecoin: Trump-backed World Liberty has entered the blockchain space with a new stablecoin on Ethereum and BNB Chain. The smart contract was deployed 20 days ago, indicating a strategic rollout amid market stability. However, the project has sparked debate over its alignment with crypto ideals and raised questions about potential regulatory scrutiny due to its high-profile backing.

Russia Turns to Crypto for Oil Trade: Russia is reportedly using Bitcoin, Ethereum, and USDT to facilitate oil trade, converting Chinese yuan and Indian rupees into Russian rubles. According to Reuters, while this remains a small portion of total transactions, its usage is growing.

Pakistan Moves to Legalize Bitcoin: After years of restrictions, Pakistan plans to legalize Bitcoin and altcoins by introducing a regulatory framework aimed at attracting foreign investment and driving adoption.

Keep an eye on 👀

Corporate Bitcoin Stacking Accelerates: Strategy (formerly MicroStrategy) has added another 6,911 BTC for $584.1 million, bringing its total holdings to 506,137 BTC—roughly 2.4% of Bitcoin’s fixed supply—now valued at over $44 billion. Japanese investment firm Metaplanet continued its Bitcoin accumulation with a $12.6 million purchase, while video platform Rumble acquired 188 BTC for $17.1 million as part of its treasury strategy.

Tweet Of The Week 🐥

CoinMENA News 🗞️

“Your Future, Your Choice” – Bold New Bitcoin Ads: We’re excited to share the launch of our new campaign, “Your Future, Your Choice,” featuring two short films that tackle the financial challenges so many of us face: rising living costs and the struggle to grow savings.

These films aren’t just ads, they’re a call to rethink how we approach saving and investing in today’s world.

👉 Watch the films here: Film 1 & Film 2.

Quiz Corner ✅

Last week’s question, What are Real-World Assets (RWAs) in crypto?

The correct answer is A) Physical assets like real estate and commodities tokenized on the blockchain

This week’s question: True or false: Tether was the 10th largest buyer of U.S. Treasures in 2024.

See the answer in next week’s newsletter. Or check out our learning platform https://university.coinmena.com/

Invest in the future of finance today with CoinMENA

Related Articles

Kalam Crypto #151: Tariff Wars Update: Trump & America Blink

Kalam Crypto #150: Tariff Wars & Bitcoin in the New Economic Order

Kalam Crypto #148: XRP Surges After SEC Drops Appeal