Kalam Crypto #151: Tariff Wars Update: Trump & America Blink

Ahlan wa sahlan, and welcome to the 151st edition of CoinMENA’s weekly newsletter, Kalam Crypto!

“The Fed is absolutely ready to help stabilize the market if needed.” Susan Collins, Boston Fed President

Ahlan wa sahlan, and welcome to the 151st edition of CoinMENA’s weekly newsletter, Kalam Crypto! This week, we continue our deep dive into the U.S.-instigated tariff wars and the market chaos they’ve unleashed. From erratic policy moves to alarm bells ringing in the bond market, we’re witnessing a real-time shift in the global economic order and, of course, exploring what it all means for Bitcoin.

TL;DR

Trump blinked: He paused tariffs on most countries… except China.

Then blinked again: Critical sectors like tech were quietly exempted.

Markets are reeling: Stocks are down, but instead of bonds acting as a safe haven, yields are spiking.

The Fed is getting ready to “stabilize”: Money printer is warming up.

Bitcoin holding up: Since the Trump election 6 months ago, BTC +30%, S&P -9%

📕Historical Context: The U.S. Trade Deficit Flywheel

For decades, the U.S. has run massive trade deficits, importing goods from around the world and exporting dollars in return. Here’s how the cycle worked:

The U.S. bought goods from countries like China, Japan, and Germany.

Those countries received dollars—and didn’t just hold them.

They recycled those dollars back into U.S. assets, especially stocks and Treasury bonds.

This cycle created constant demand for U.S. equities and bonds, helping fuel their long-standing outperformance relative to the rest of the world.

But now, that flywheel is breaking.

Trump’s tariffs are raising the cost of production for U.S. companies. That squeezes profit margins, which leads to lower stock prices—and we’re already seeing major selloffs in the S&P 500, and for the first time, bonds are also selling off at the same time.

📉Equities Down, Bonds… Also Down?

Historically, when equities fall, bonds rally. Investors usually seek refuge in Treasuries during downturns. But not this time.

Instead, we’re seeing a bond market selloff alongside equities. The 10-year Treasury yield surged from 4% to over 4.5% in just days. That’s the market screaming:

"We don’t want to lend to the U.S. government for 10 years at these rates."

This isn’t just a blip, it’s a signal that the so-called “risk-free rate” is no longer risk-free. If Treasuries, the backbone of global finance, are unstable, every asset class built on them is vulnerable.

🏛️The Fed’s Dilemma: Stabilize or Step Back?

With both equities and bonds under pressure, all eyes turn to the Fed.

Jamie Dimon recently warned of a “Treasury market kerfuffle,” suggesting the Fed might have to intervene. Boston Fed President Susan Collins echoed that sentiment, saying the Fed is “absolutely ready” to stabilize the market.

Translation: either collapse… or the money printer goes brrr.

🟠The Case for Bitcoin: Scarce, Neutral, and Permissionless

In a multipolar world where global capital flows are increasingly weaponized, neutral reserve assets are no longer optional; they're essential.

Historically, gold filled this role, but in today’s fast-moving digital economy, gold has major limitations. It’s slow, centralized, and requires trusted intermediaries to move and settle, making it vulnerable to manipulation.

Bitcoin, by contrast, is built for this era. It is:

Scarce: Only 21 million will ever exist, making it the ultimate hedge against currency debasement.

Transportable: It can be sent globally in minutes.

Verifiable: Anyone can audit the supply at any time.

Permissionless: No central authority can censor or confiscate.

Digital & Open: Ideal for a global, 24/7 economy.

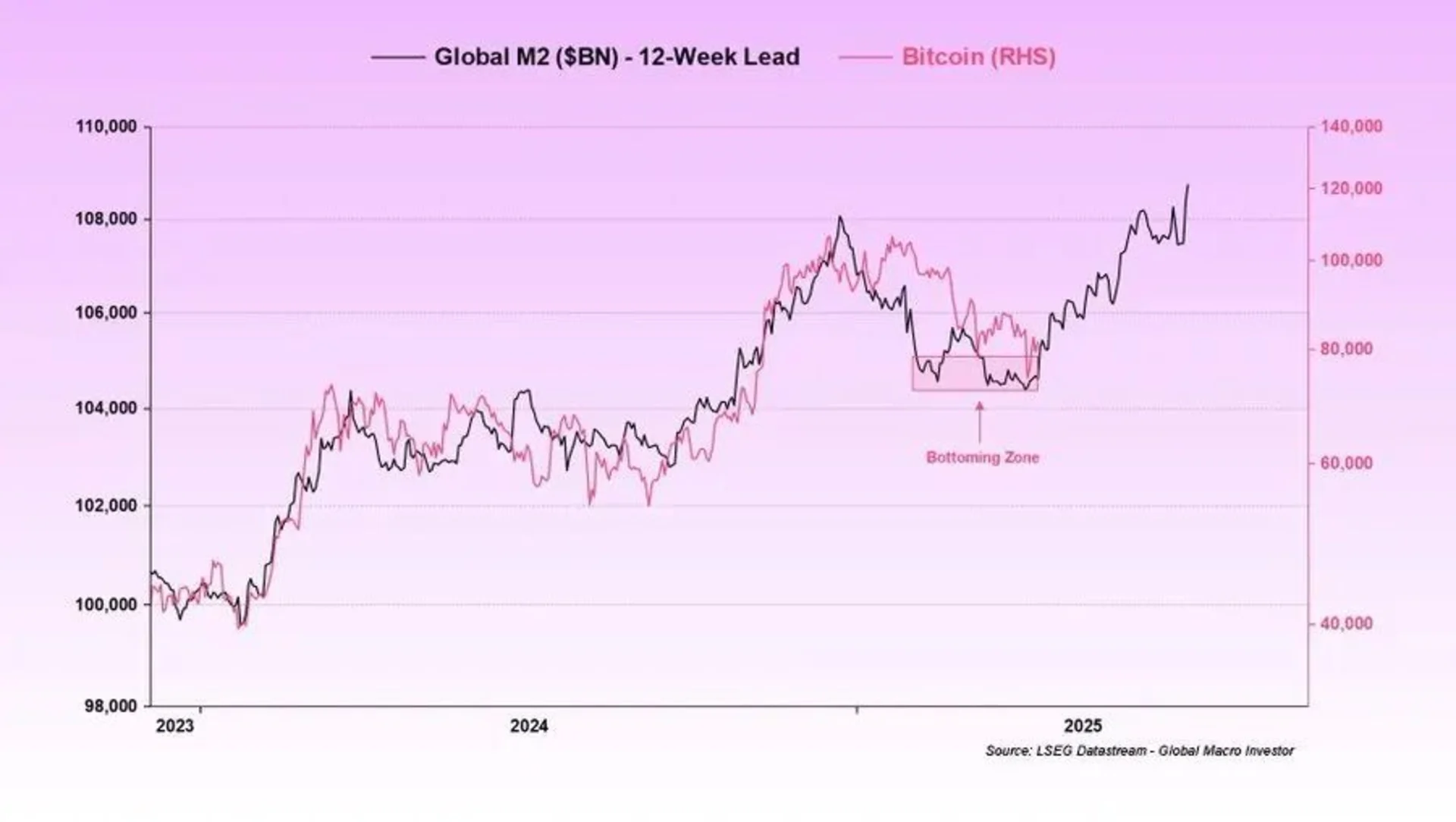

Importantly, Bitcoin’s price has historically shown a strong correlation with global M2 money supply—the broader definition of “money” in the system.

As the chart below shows, when M2 expands, Bitcoin rallies. With central banks likely forced to restart liquidity measures to stabilize markets, if this historical trend holds, we could see Bitcoin break out again in the coming month.

In a world where U.S. equities are under pressure and bond markets are flashing red, Bitcoin is emerging not just as a speculative asset but as a risk-off safe haven for the digital age.

🧘♂️Keep Calm & Zoom Out

We’ve seen moments of panic before. In 2020, markets sold off hard during COVID, only to recover spectacularly. The fear was real, but the logic was off: the world wasn’t going to stay closed forever.

This moment feels more complex, but the takeaway is the same: Don’t make emotional decisions.

Despite the volatility, Bitcoin is still above its all-time high from just six months ago. The fundamentals haven’t changed, and those who understand Bitcoin’s long-term potential know that these dips are opportunities.

We are entering a new economic era. For investors who see the writing on the wall, Bitcoin might be the most important asset to hold.

Invest in the future of finance today with CoinMENA

Related Articles

Kalam Crypto #150: Tariff Wars & Bitcoin in the New Economic Order

KC #149:UAE expands crypto investments & favorable regulations from the U.S.

Kalam Crypto #148: XRP Surges After SEC Drops Appeal