Kalam Crypto#147:US Announces Strategic Bitcoin Reserve,Digital Assets Stockpile

Ramadan Kareem, and welcome to the 147th edition of CoinMENA’s weekly newsletter, Kalam Crypto!

"First they ignore you, then they laugh at you, then they fight you, then you win."

Ramadan Kareem, and welcome to the 147th edition of CoinMENA’s weekly newsletter, Kalam Crypto!

This week brings a historic announcement from the United States as President Trump signs an executive order to establish a Strategic Bitcoin Reserve and a Digital Assets Stockpile, marking a significant milestone in the global Bitcoin race. Despite this, markets, including stocks and Bitcoin, are facing downward pressure. We take a closer look at the broader macroeconomic factors influencing Bitcoin’s price. Additionally, a recent report highlights the UAE’s growing role in the Bitcoin ecosystem, holding nearly 4% of the global Bitcoin hashrate.

All this and more in this week’s Kalam Crypto!

Global News 🌍

Trump signs Executive Order to establish a Strategic Bitcoin Reserve and Digital Assets Stockpile: President Trump has signed an Executive Order to create a Strategic Bitcoin Reserve and a U.S. Digital Asset Stockpile. The Reserve will hold the bitcoin obtained through forfeiture, undergo an audit, and will not sell any Bitcoin. The Digital Asset Stockpile will include other non-Bitcoin assets acquired via forfeiture. The Secretaries of Treasury and Commerce will develop budget-neutral strategies to acquire more Bitcoin for the Reserve, but no similar plans are in place for non-Bitcoin assets. This marks a significant step in the U.S. government's focused approach to Bitcoin, distinct from broader cryptocurrency strategies. The move underscores the growing importance of Bitcoin in national financial strategies, prompting the question, who will be next?

The SEC Drops More Crypto Cases: The SEC has dropped several high-profile crypto cases, including those against Kraken, Cumberland, and Yuga Labs. Kraken was accused of operating as an unregistered securities exchange, while Cumberland faced similar allegations. Yuga Labs had been under investigation for three years regarding whether certain NFTs qualified as securities. With these dismissals, the SEC has now dropped 11 crypto-related cases in the past month, signaling a potential shift in its enforcement approach.

Local News 📍

UAE Among World Leaders in Bitcoin Hashrate: A recent River Bitcoin Adoption report highlights the UAE as a significant player in the global Bitcoin hashrate, holding 3.75%, surpassing Canada (3%), Kazakhstan (2.5%), and Paraguay (3.5%). The United States leads with 36%, followed by Russia (16%) and China (14%). The report reveals that 28 countries contribute less than 0.1% to the hashrate, while nine countries hold 1%. With 94% of the 21 million Bitcoin supply already mined, the remaining 6% will take up to 115 years to mine. Public companies account for 35.2% of the hashrate, while individuals own 69.4% of Bitcoin supply, followed by ETFs (6.1%), governments (1.4%), and businesses (4.4%). Despite its growth, global Bitcoin ownership remains below 4%.

Blog of The Week ✍️

CoinMENA CEO Talal Tabbaa shares his perspective on the U.S.'s historic decision to establish a Strategic Bitcoin Reserve. https://www.coinmena.com/en/blog/3KBJo0uQxbm9XR4bieOK5F

Keep an eye on 👀

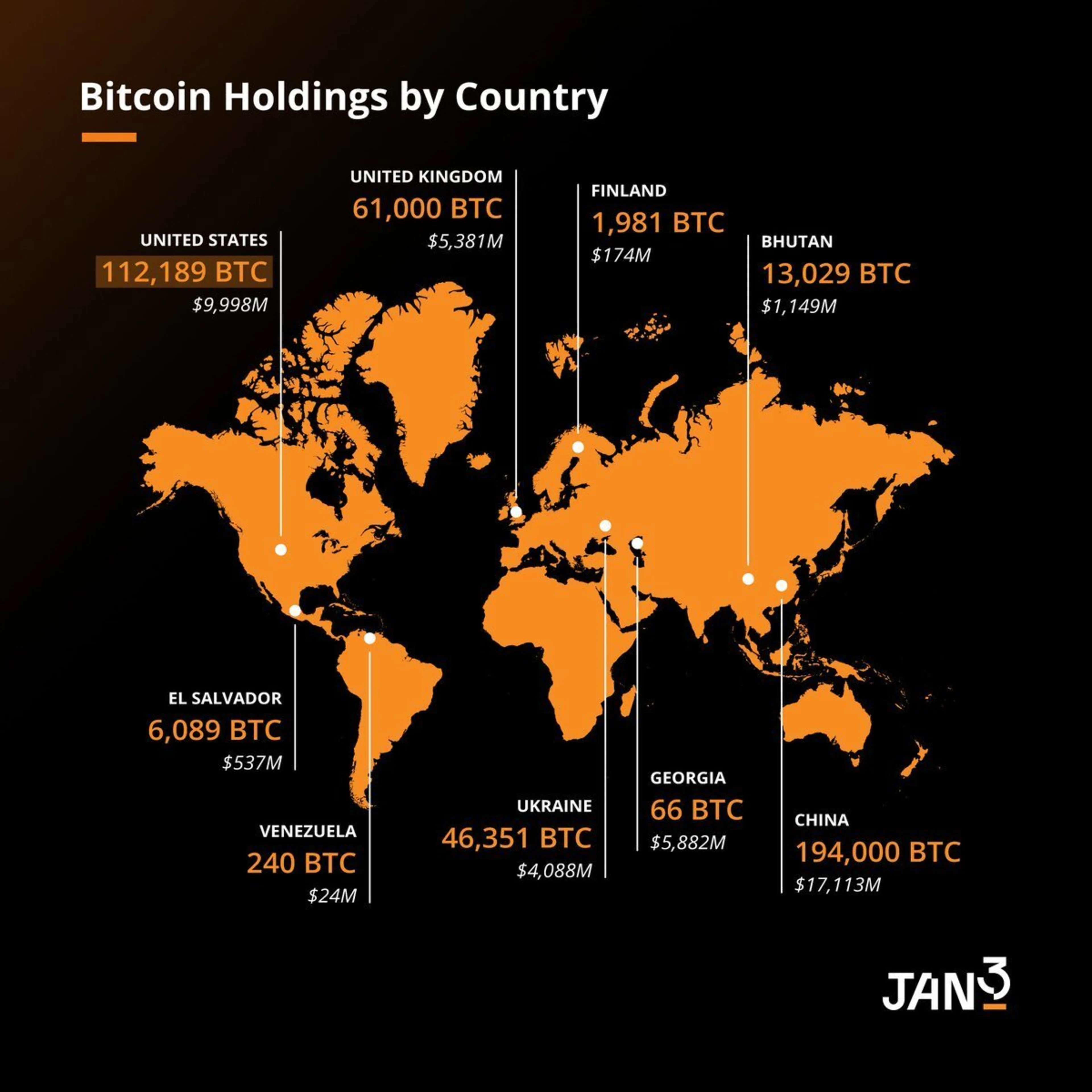

The bitcoin accumulation race is on! How do you think this map will look next year?

When in Doubt, Zoom Out 🔍

Why is bitcoin’s price going down after the historic announcement? Despite the historic announcement of a Strategic Bitcoin Reserve (SBR), Bitcoin's price has not surged due to broader market pressures, including tariffs, rising layoffs, and a pullback in global liquidity, which have rattled investors and dragged down both stocks and Bitcoin. However, liquidity is a key driver, and early signs suggest it is rebounding, which historically correlates strongly with Bitcoin's performance.

Meanwhile, the Trump administration appears to be leveraging tariffs to create market uncertainty, slowing short-term growth and driving investors toward bonds, thereby lowering yields. This strategy aims to reduce refinancing costs for the $7 trillion debt due in the next six months, as lower yields would allow the Fed to cut rates, easing refinancing pressures. While tariffs are typically seen as inflationary, the current uncertainty is pushing bond prices up and yields down, aligning with the administration's short-term economic goals.

Tweet Of The Week 🐥

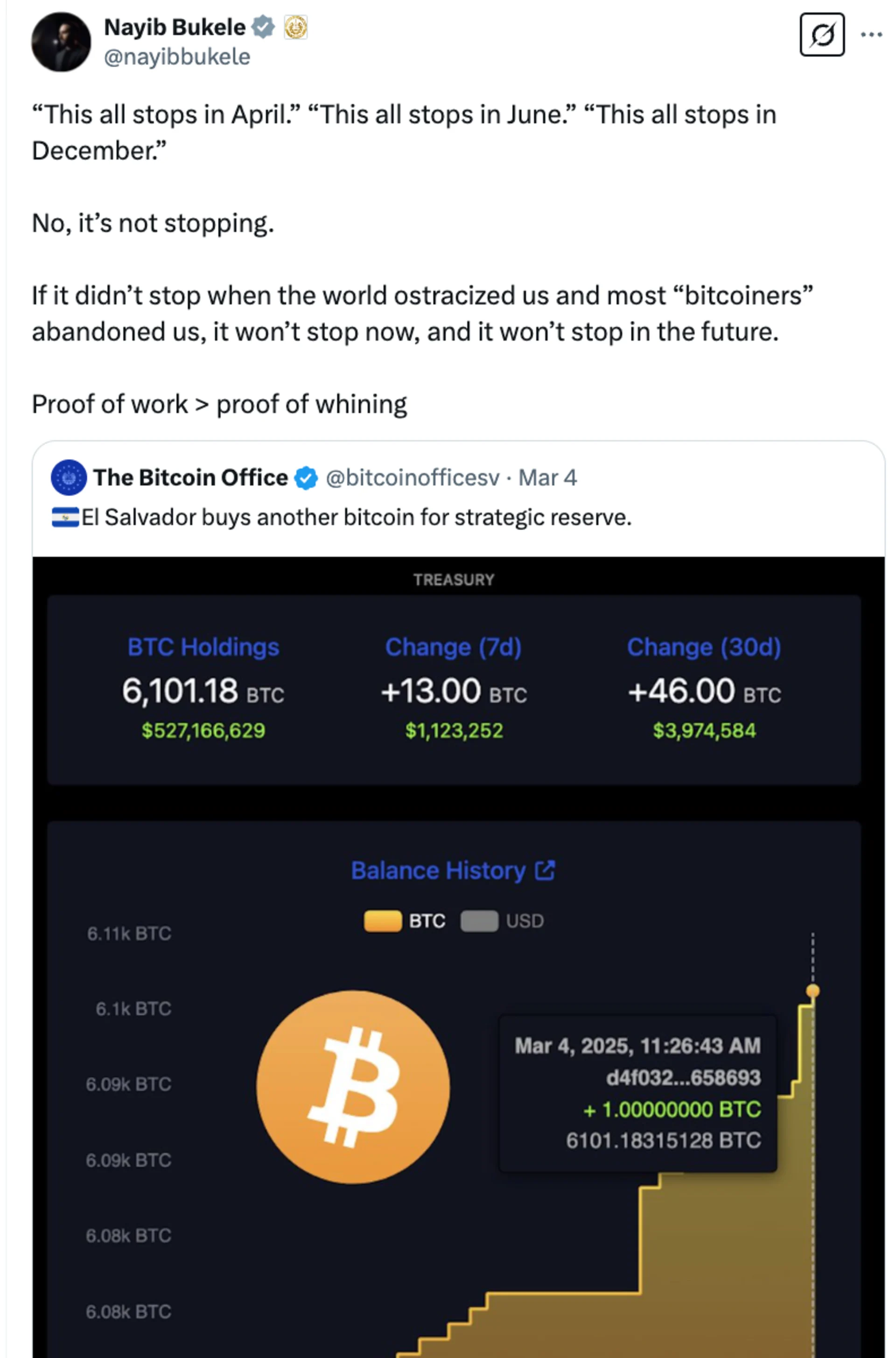

This is definitely a candidate for tweet of the year! In the wake of IMF reports suggesting that part of the IMF loan to El Salvador is contingent on the country ceasing its Bitcoin purchases, the president appears to be defying them with the following tweet:

CoinMENA News 🗞️

“Your Future, Your Choice” – Bold New Bitcoin Ads: We’re excited to share the launch of our new campaign, “Your Future, Your Choice,” featuring two short films that tackle the financial challenges so many of us face: rising living costs and the struggle to grow savings.

These films aren’t just ads, they’re a call to rethink how we approach saving and investing in today’s world.

👉 Watch the films here: Film 1 & Film 2.

Quiz Corner ✅

Last week’s question, which assets does President Trump want to include in the U.S. Crypto Reserve? Correct answer was D) BTC, ETH, XRP, SOL & ADA

This week’s question: What is the main difference between the Strategic Bitcoin Reserve (SBR) and the Digital Assets Stockpile?

A) The SBR will sell Bitcoin periodically, while the Digital Assets Stockpile will hold assets indefinitely. B) The SBR will not sell Bitcoin and will acquire more, while the Digital Assets Stockpile will hold non-Bitcoin assets without acquiring more. C) Both the SBR and the Digital Assets Stockpile will actively buy and sell assets to maximize profits. D) The SBR will focus on non-Bitcoin assets, while the Digital Assets Stockpile will focus exclusively on Bitcoin.

See the answer in next week’s newsletter. Or check out our learning platform https://university.coinmena.com/

Invest in the future of finance today with CoinMENA

Related Articles

Kalam Crypto #151: Tariff Wars Update: Trump & America Blink

Kalam Crypto #150: Tariff Wars & Bitcoin in the New Economic Order

KC #149:UAE expands crypto investments & favorable regulations from the U.S.