Stablecoins in a high-interest environment

Fintech and payment giant PayPal just launched a stablecoin PYUSD as an ERC-20 token on the Ethereum blockchain.

Fintech and payment giant PayPal just launched a stablecoin PYUSD as an ERC-20 token on the Ethereum blockchain. There are many reasons why PayPal would want to enter the stablecoin market. Cryptocurrencies are a superior payment technology, with near-instant final settlement, and much lower costs. However, the main reason PayPal launched PYUSD is that, in these high-interest environments, the stablecoin business literally prints money.

When a stablecoin issuer issues a token, they are supposed to maintain a 1:1 ratio of cash or cash equivalents for each token. Short-term U.S. treasury bills (T-Bills) are considered cash equivalents, and this is where the stablecoin business is a cash cow, especially during high-interest rates times. Let’s say a stablecoin issuer has 10 billion in circulation, they would hold a small percentage of that amount in cash, and the majority in short-duration treasury bills. Those treasury bills right now are yielding anywhere from 4% to 6%. Crucially, these yields are not passed down to the stablecoin users because that would classify them as securities. Just look at the performance of the top two stablecoin issuers in the world right now, USDT by Tether, and USDC by Circle:

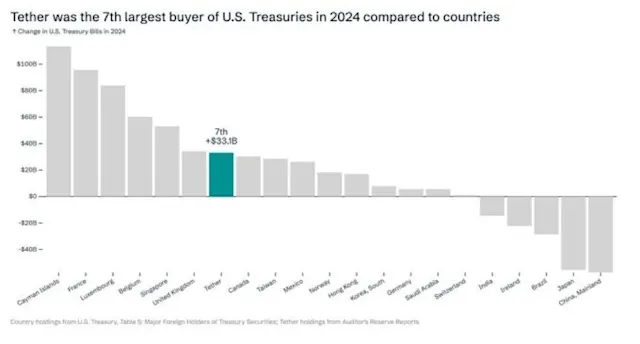

According to their latest attestation, Tether’s Q2 profit was $1 billion! Their “Excess Reserves” increased by 850 million to $3.3 billion. To be clear, that’s $3.3 billion dollar of excess reserves on top of the 100% reserves backing the USDT tokens. To give you some frame of reference on the scale, Tether currently holds $72.5 billion in U.S. T-bills, making it the 23rd biggest holder of U.S. debt in the world, just behind the Netherlands and ahead of countries like Australia and Mexico.

Circle, the issuer of the second largest stablecoin USDC, had $779 million in revenue in the first half of the year, already surpassing the $772 million for all of 2022. Circle now has over $1 billion in cash on its balance sheet as of June.

In addition to profiting off T-Bills, moving dollars is by far the most prevalent utility of blockchains so far. Despite being ~10$% of the crypto market cap, stablecoins account for ~75% of total transaction volume!

Historically, when superior technologies infiltrate the market, incumbents have two options: either embrace the innovation and reconfigure their business models, or engage in resistance through lobbying and regulatory measures. Ultimately, the principles of the free market tend to gravitate toward superior technologies, irrespective of resistance. Just as automobiles inevitably replaced horse-drawn carriages and email supplanted traditional mail, cryptocurrencies are poised to become the preferred vehicle for transferring value.

So the question is not why is PayPal entering the stablecoin business, it's why wouldn't they?