Kalam Crypto #140: Tether Relocates Headquarters to El Salvador!

This week, Tether, the issuer of USDT and the most profitable company in the world per employee, announced its relocation to El Salvador—the first country to recognize Bitcoin as legal tender in 2021.

“Intensity is common, consistency is rare.”

Ahlan wa sahlan, and welcome to the 140th edition of CoinMENA’s weekly newsletter, Kalam Crypto!

This week, Tether, the issuer of USDT and the most profitable company in the world per employee, announced its relocation to El Salvador—the first country to recognize Bitcoin as legal tender in 2021. This move underscores how emerging economies like El Salvador are embracing Bitcoin and attracting major players like Tether. Meanwhile, in stark contrast, the U.S. is deliberating whether to sell 69,000 BTC seized from the Silk Road, highlighting differing approaches to Bitcoin between developed and emerging markets. Plus, CoinMENA proudly joins Mastercard’s Crypto Credentials program in the UAE. All this and more in this week’s edition of Kalam Crypto!

Global News 🌍

Tether relocated to El Salvador: Tether, the world’s largest stablecoin issuer, is finalizing its move to El Salvador after acquiring a Digital Asset Service Provider license. As the first country to adopt Bitcoin as legal tender in 2021, El Salvador is establishing itself as a global hub for digital assets, thanks to progressive policies, a favorable regulatory framework, and a growing Bitcoin-savvy community.

Why does this matter?

Tether, the world’s most profitable company per employee, reporting 2024 profits comparable to Goldman Sachs but with a fraction of the workforce, is relocating to the world’s most crypto-friendly nation. El Salvador’s Bitcoin-forward president, Nayib Bukele, has led efforts to integrate Bitcoin, purchasing 1 BTC daily for the past two years and are currently up over 100% on their investment. This move reflects a significant shift in global capital flows, as investments transition from developed nations to emerging markets with favorable regulatory environments.

Related News: El Salvador recently added 11 BTC to its reserves, bringing its total holdings to over 6,022 coins. The best part? These reserves are fully transparent and can be verified by anyone. Simply paste the country’s official Bitcoin address into mempool.space. https://mempool.space/address/32ixEdVJWo3kmvJGMTZq5jAQVZZeuwnqzo

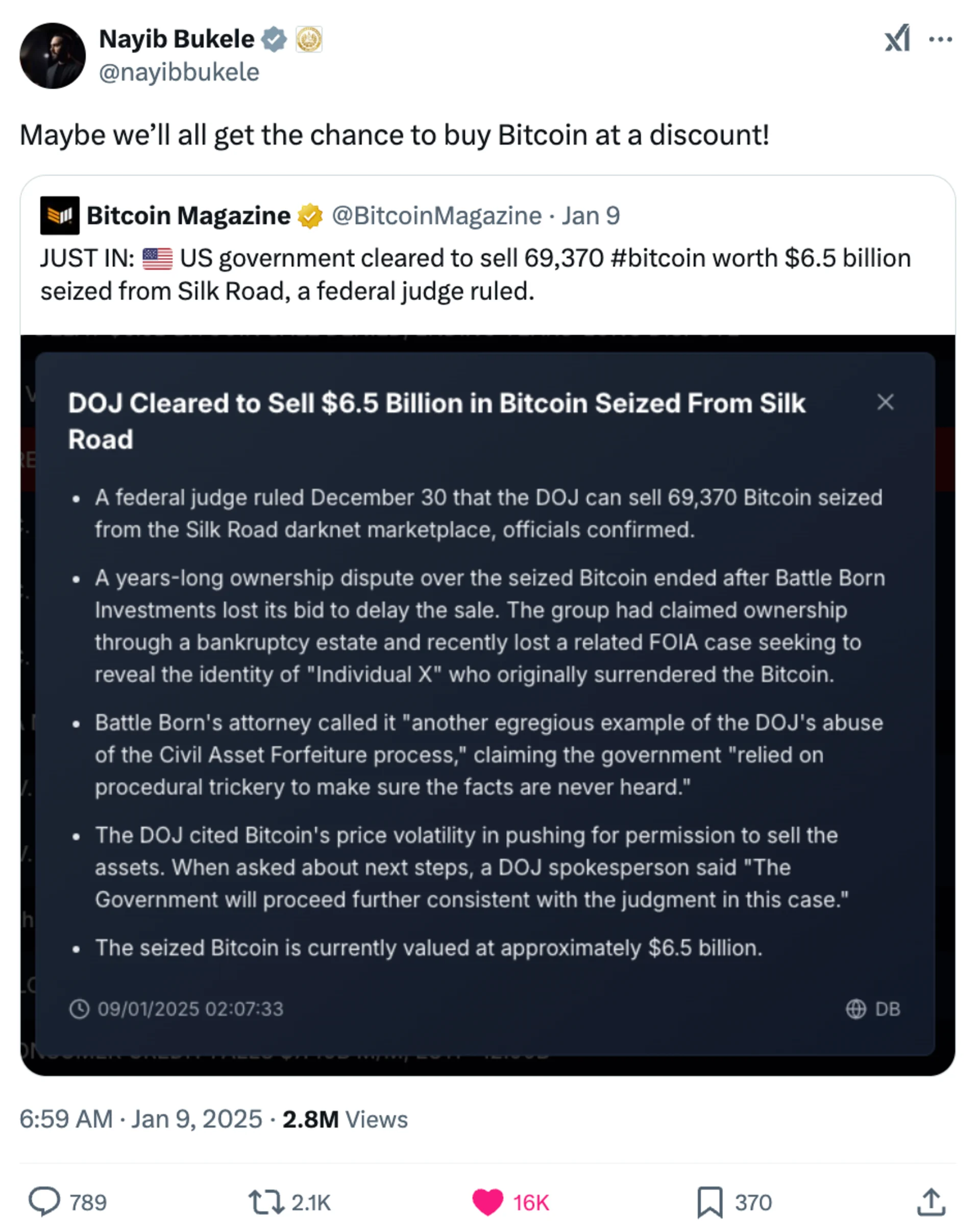

Will the U.S. Liquidate $6.5B in Bitcoin as Trump Prepares Crypto Policy Shake-Up?: The U.S. government has received court approval to liquidate 69,370 BTC, valued at $6.5 billion, seized from the Silk Road marketplace after a four-year legal battle. Chief Judge Richard Seeborg denied efforts to block the forfeiture, enabling the Department of Justice to proceed with the sale, though immediate liquidation may be delayed due to administrative steps. Meanwhile, as highlighted by The Washington Post, incoming President Donald Trump is expected to issue executive orders on his first day in office addressing Bitcoin and crypto policies, potentially reshaping the regulatory landscape.

Local News 📍

CoinMENA Joins Mastercard Crypto Credential Pilot in the UAE: Mastercard has launched its innovative Crypto Credential solution in the UAE and Kazakhstan, marking its debut in the EEMEA region. This solution simplifies cryptocurrency transactions by allowing users to send and receive funds using simple aliases instead of complex blockchain addresses while ensuring verification and compliance through blockchain networks. Key partners in this pilot include CoinMENA, enabling enhanced security and usability for consumers and businesses across the Middle East and Eastern Europe.

Keep an Eye On 👀

At some point in the future, we’ll stop reporting this as news since it happens so frequently, but this buy seems like a milestone. MicroStrategy has acquired an additional 2,530 BTC for ~$243 million at an average price of ~$95,972 per Bitcoin, bringing its total holdings to 450,000 BTC as of January 12, 2025. The company’s total investment stands at ~$28.2 billion, with an average cost of ~$62,691 per Bitcoin. Since adopting a Bitcoin standard on August 11, 2020, MicroStrategy has accumulated 33% of all Bitcoin issued during that period, a remarkable feat considering 1.352 million BTC have entered circulation since then.

Tweet Of The Week 🐥

CoinMENA News 🗞️

🫂Double Referral Week: Enjoy double referral rewards this week, only until January 19th! Share your custom referral link with friends, and family, or on your social media channels, and earn $10 for every successful referral when your friend signs up and verifies their account on CoinMENA. There’s no limit to how much you can earn, the more you invite, the more you earn!

Quiz Corner ✅

Last week’s question: What was the single-day ETF inflow that helped Bitcoin climb back over $100k this week? The correct answer is a $987 million

This week’s question, what are El Salvador’s returns so far on their bitcoin investment?

-50%

-100%

+50%

+100%

See the answer in next week’s newsletter. Or check out our learning platform https://university.coinmena.com/

Invest in the future of finance today with CoinMENA

Related Articles

KC #149:UAE expands crypto investments & favorable regulations from the U.S.

Kalam Crypto #148: XRP Surges After SEC Drops Appeal

Kalam Crypto#147:US Announces Strategic Bitcoin Reserve,Digital Assets Stockpile