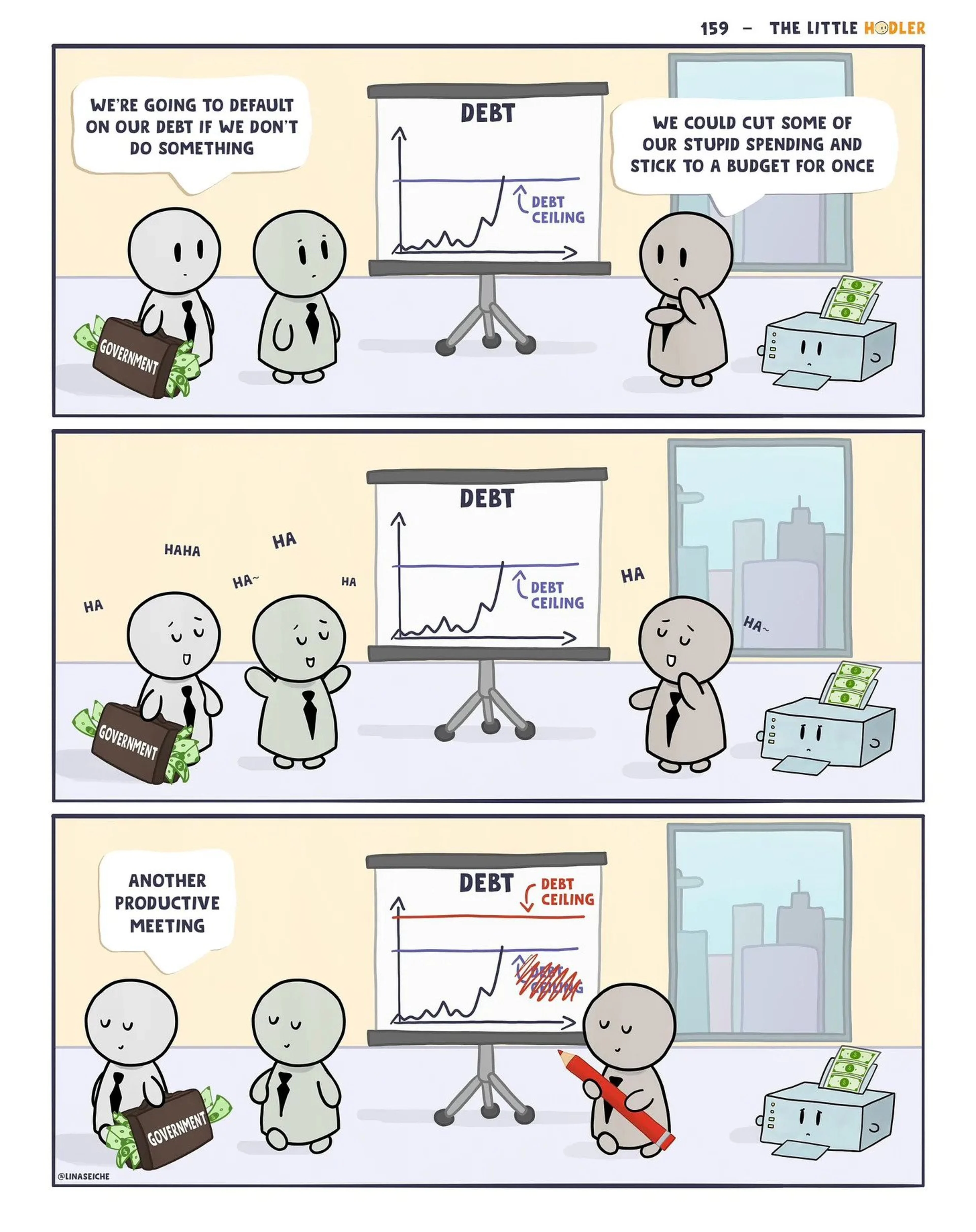

Debt Ceiling: Who Cares?

After some political posturing, U.S. lawmakers have agreed to suspend the debt ceiling, again, staving off a potential U.S. government default, again.

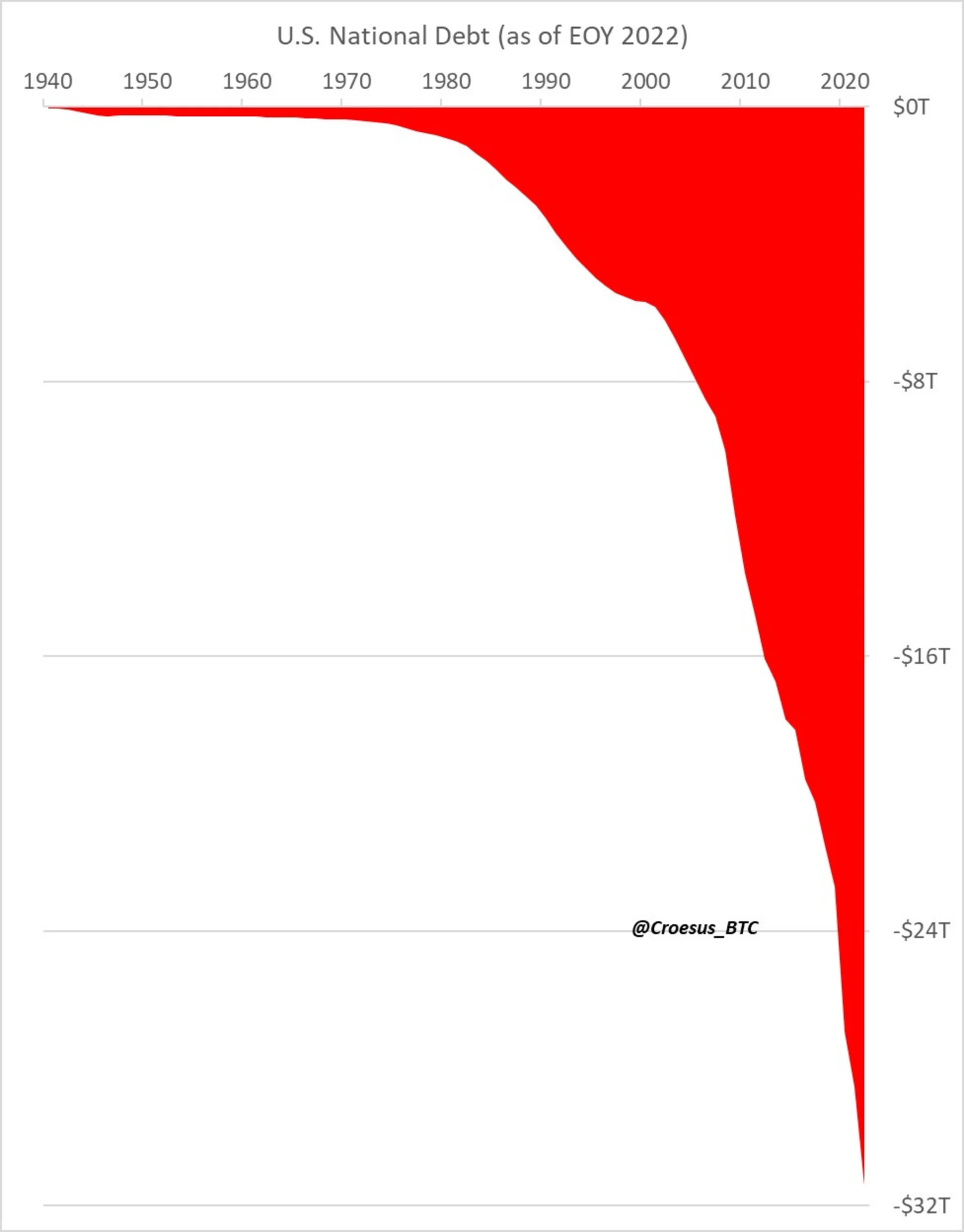

After some political posturing, U.S. lawmakers have agreed to suspend the debt ceiling, again, staving off a potential U.S. government default, again. The debt ceiling is a self-imposed upper limit on the amount of money a government can borrow. The current U.S. debt stands at $31.9 trillion. In 2020 (pre covid) it was $23 trillion and in 2008 (pre-GFC) $9.5 trillion. Meaning, the U.S. debt has increased roughly 231% since the 2008 crisis, and with the recent agreement is expected to continue increasing at an accelerated pace, reaching $50 Trillion by 2030! What does that mean? and should we care?

Before we dive into this, I like to point out this example so we comprehend the scale of numbers we’re talking about here. A million seconds is 11 days, a billion seconds is 31 years, and a trillion seconds is 31,710 years. YEARS! The point is, $31.9 trillion dollars is a lot of money.

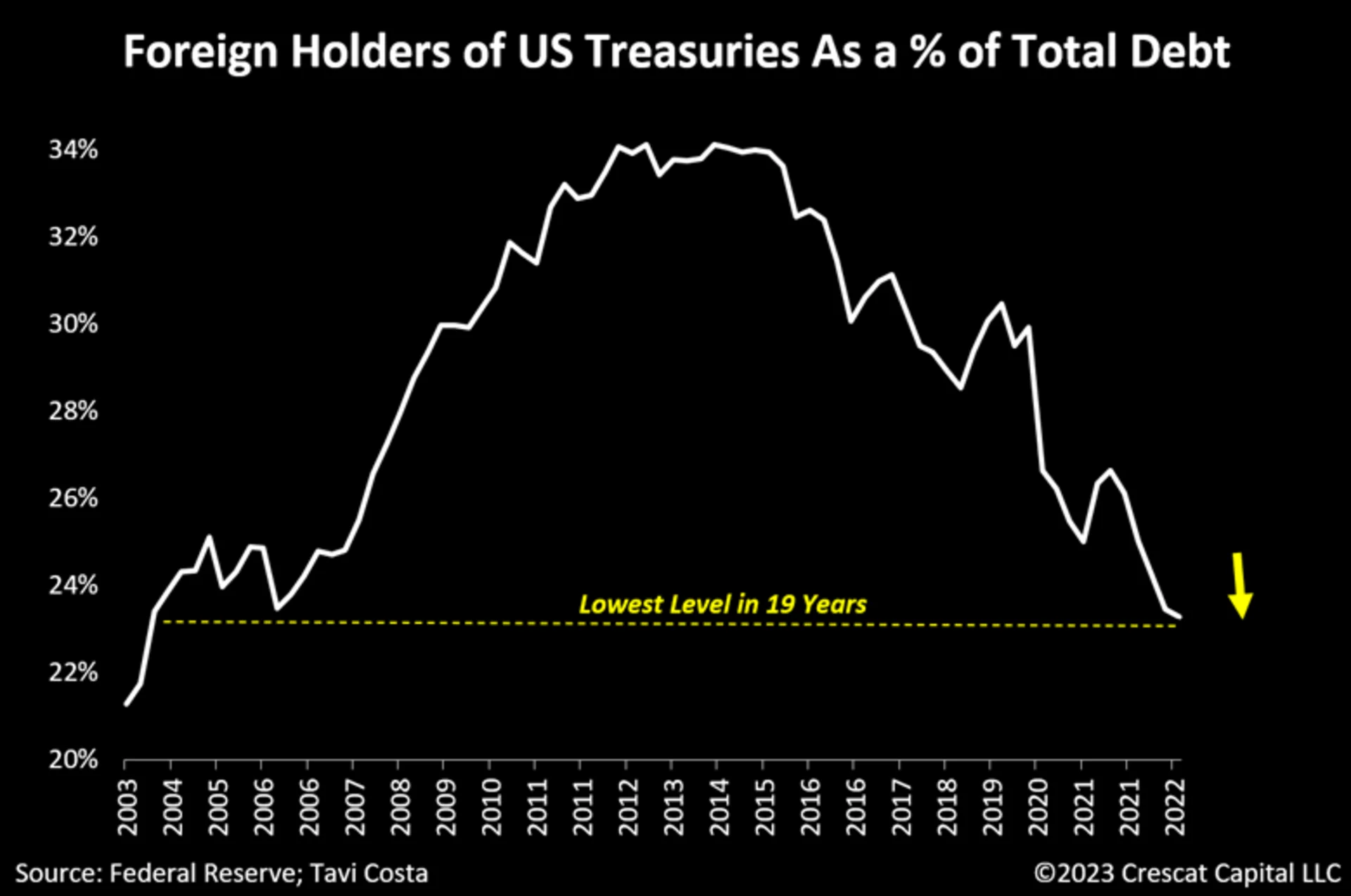

Debt is increasing because the government is running a deficit, meaning the revenue it generates does not cover its expenses. In 2022, the deficit was “just” $1.4 trillion, and 2023 we are on pace for a $2 trillion deficit. When a government runs a deficit, like all of us, they are forced to borrow. The debt instrument is US treasuries (bonds). Government issues them at a specific interest rate, and market participants buy them. Since the U.S. has been the world’s superpower for a few decades now, and the dollar is the global reserve currency, there’s been no shortage of buyers for this debt. In fact, the market is so confident of these treasures they refer to them as “risk-free rate”, i.e. safest thing to invest in because the world’s only superpower backs it, and they will not default. At least, that's the idea.

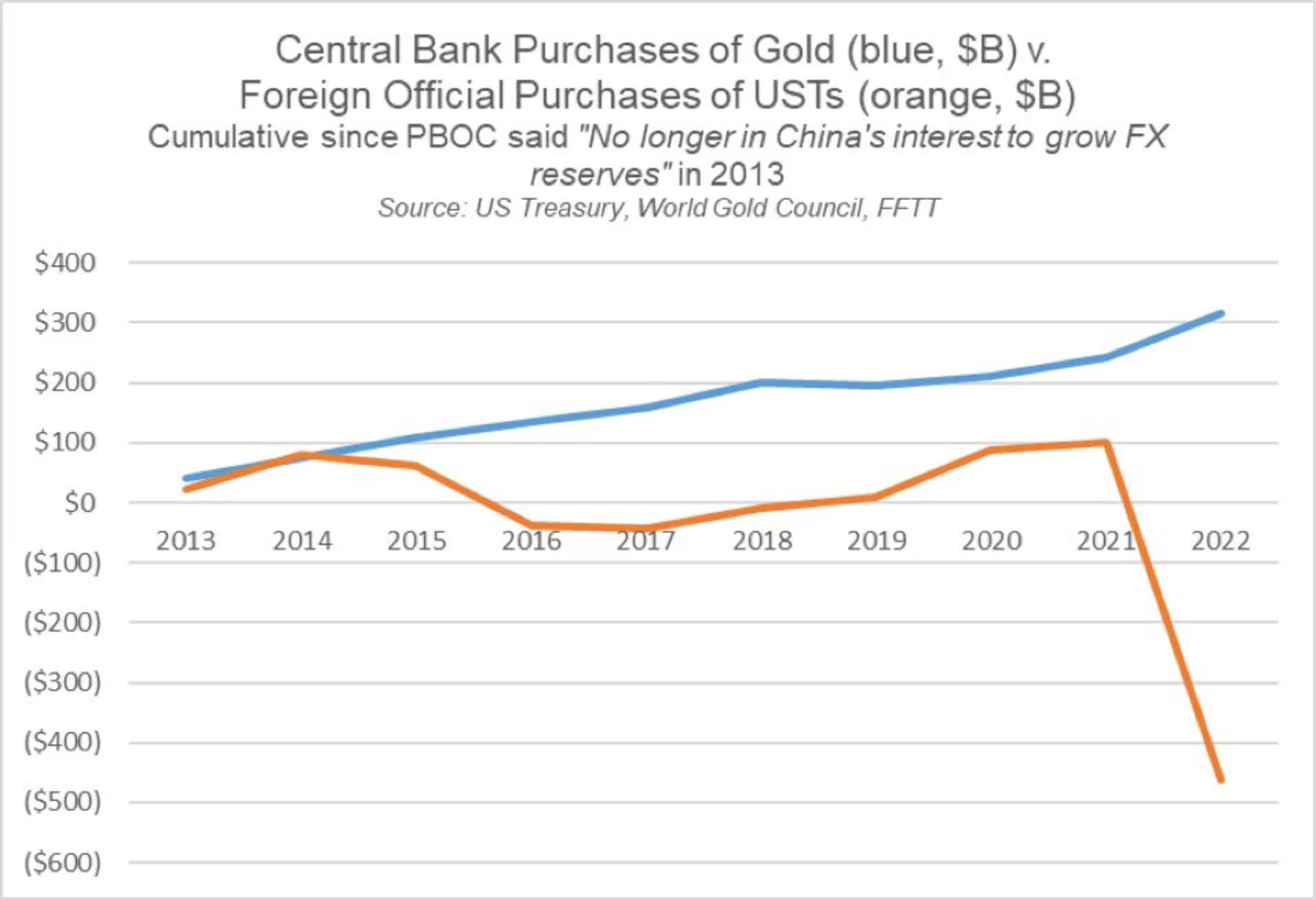

The risk-free narrative took a big hit in March when it directly caused the banks who bought them to collapse (see my write-up from that time) as they miscalculated duration risk on these supposedly risk-free assets. In the past couple of decades, foreign governments like China were the largest holders of U.S. bonds. While demand is still strong in absolute terms, in relative terms, foreign governments are diversifying away from U.S. bonds and into hard assets like Gold.

One thing that shockingly few people question or acknowledge is where does the money for this new debt come from? The answer is the Central Bank, (Federal Reserve). But where does the Federal Reserve money come from, and the correct answer is, from thin air. They create it instantly with a stroke of a key, without the backing of any commodity like gold. It is nothing more than a ledger entry. Therefore, there is essentially an infinite supply of new money to plug deficits.

The question now becomes, should we care about infinite money creation and infinite debt? When you consider that the collapse of almost every empire and global reserve currency was the result of excessive debt and money printing, then you absolutely should. It sounds dramatic, but cycles repeat; a fact that most conveniently ignore.

When a superpower gets locked in a debt spiral like the U.S. is in right now where the deficit is accelerating, and interest rate expenses are increasing, the inevitability of the outcome becomes clear. History doesn’t repeat itself, but it often rhymes: Since 1800, in 51 out of 52 cases where a country’s debt-to-GDP ratio reached 130%, the country eventually defaulted. The only exception is present-day Japan, who’s in the final stages right before defaulting (yield curve control & money supply expansion). The U.S. current debt-to-GDP ratio is 129%. Again, should we care? Let’s look at some scenarios of how this could play out:

Balance the budget by cutting spending or increasing taxes: Unlikely, as no politician will get elected on these platforms, high time preference problem. Or

Hard default: Where the U.S. actually defaults on its promise to pay the interest to U.S. treasury holders. This is highly unlikely as it would be catastrophic to the dollar and the U.S. economy, especially since they can simply keep doing what they’ve been doing and just “print” more.

Soft default: This brings us to the third and most likely outcome, a soft default or “Inflating the debt away”: The budget deficit continues to be plugged with duct tape, newly created money, and glue. The problem with this scenario is that Increasing the supply of dollars will erode the purchasing power of each dollar (inflation).

In a soft default scenario, to entice the market to buy newly created U.S. debt (treasuries), they would have to yield positive real returns, i.e. priced higher than inflation. Today, the “official” inflation rate is ~4%. I use quotation marks because they recently changed the formula of how it's being calculated, and the CPI miraculously dropped from 9% to 4% in one year. If we use the original formula from 1980 it would be closer to ~12% today, (see Chapwood Index). But assuming you believe that inflation is only at 4%, then you would only buy U.S Treasuries if they are yielding 4% or more.

Still, who cares right? Well let’s consider this:

Money is essentially a technology to store our time and effort (work). We work today and convert our time to money so we can spend it in the future. Money is therefore an economic battery. If the money we are saving in is increasing exponentially, and losing its purchasing power along the way, then we are also losing our time and effort (work). The only way to offset that is to be a shrewd investor and beat the inflation rate, just to maintain your purchasing power. This effectively forces everyone in the world to become an investor, but what about people who just want to save their hard-earned money? What about the majority of the world who cannot access this “risk-free rate” of U.S. Treasuries?

The other option is to save our work in something scarce, with a fixed monetary supply that is open to everyone. This is where Bitcoin comes in. Bitcoin is the invention of absolute scarcity. This concept is so underrated in Bitcoin, but in my opinion, it is the most important. Bitcoin is an open, permissionless system that anyone in the world can participate in with a phone and internet connection.

There will only be 21 million bitcoin. No one can ever change that. Period.

I hold Bitcoin, because it took the U.S. government 215 years to reach $7 trillion in debt, but from 2020 to 2023, they added another $7 trillion. The Fed’s own projection expects the debt to increase from $31 to $50 trillion by 2030. Again, bitcoin is the invention of absolute scarcity, there will never be more than 21 million.

To be clear, I’m not saying that Bitcoin will replace the dollar, but it doesn't need to in order to be successful. My main argument is that, when it comes to maintaining value over time, bitcoin's limited supply is more favorable compared to the endless issuance of fiat currency. Think of bitcoin as a savings account, and Fiat as a checking account. One is for spending, and the other is for savings.

Going back to the question, should we care about the debt ceiling? For me, it's about math. If you save in Bitcoin your denominator is fixed, and you shouldn’t worry. If you save in fiat, your denominator is infinity, and you should be very worried.