Could the East trigger the next bull market run?

“Don’t fight the fed” Investors and traders have been repeating this mantra for decades. Rightfully so, the U.S. Federal Reserve has been the main driver of asset valuations.

“Don’t fight the fed” Investors and traders have been repeating this mantra for decades. Rightfully so, the U.S. Federal Reserve has been the main driver of asset valuations. But now, it seems the Fed is not the only player in town that can inject liquidity into the global market. China is making moves.

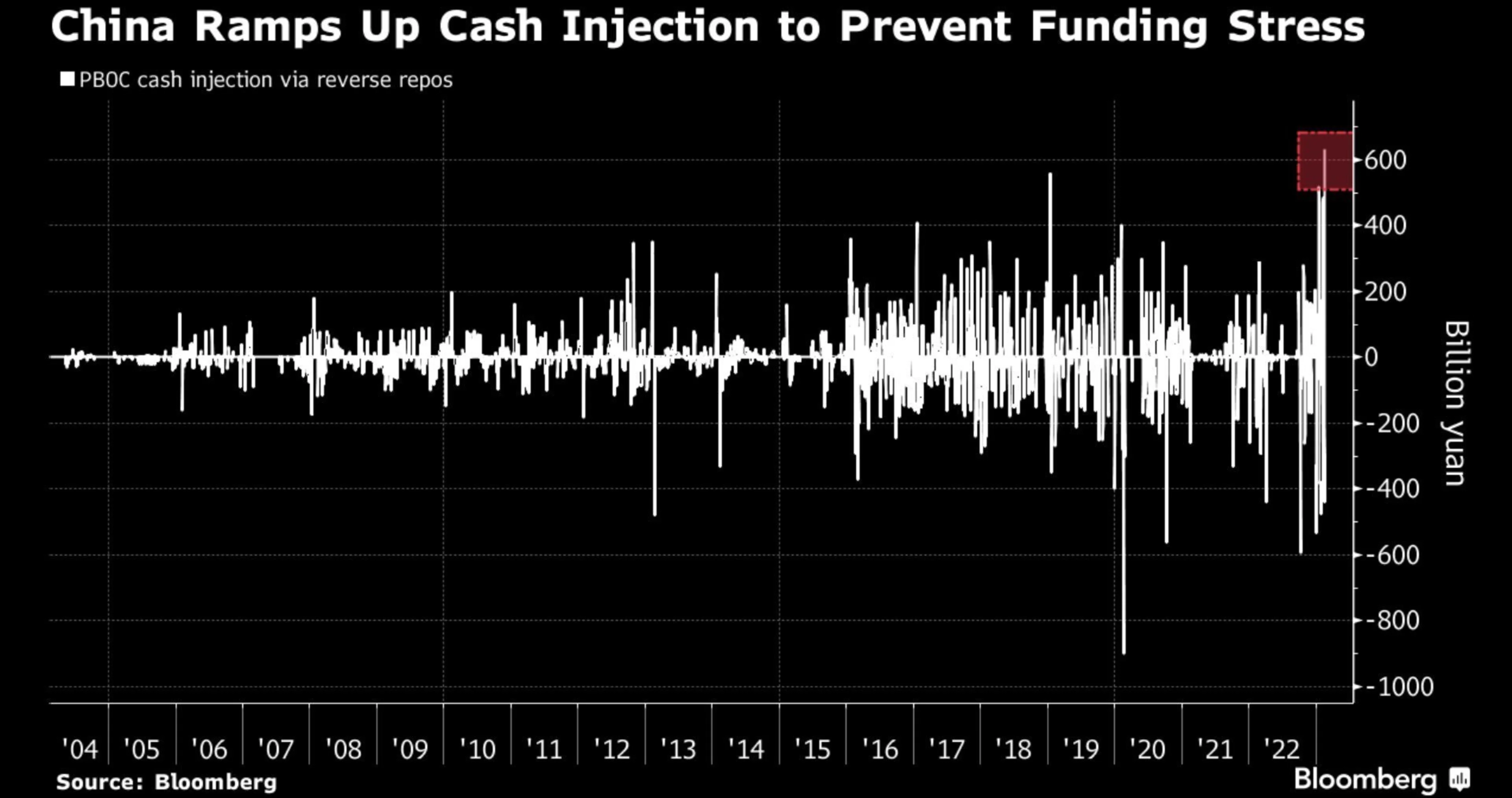

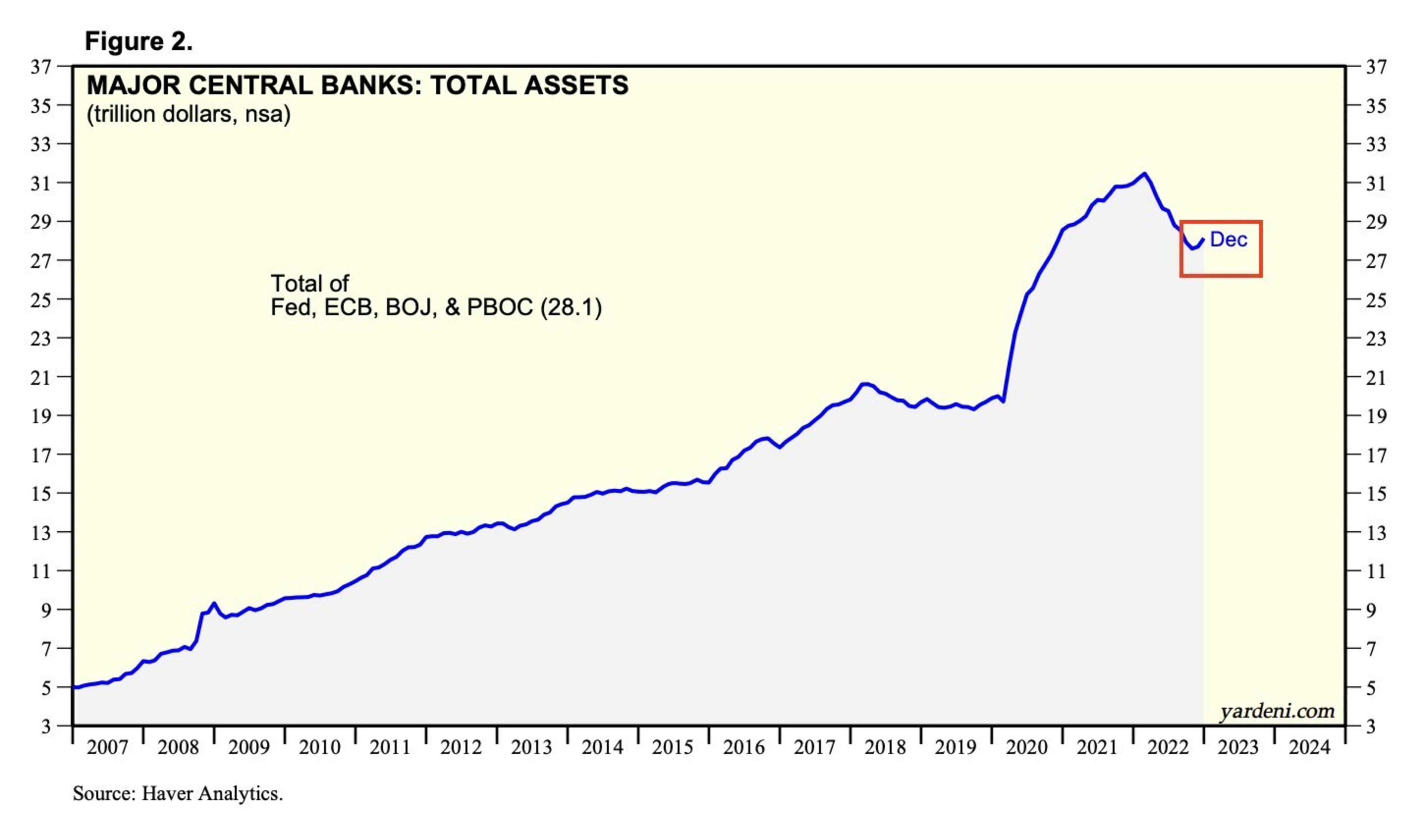

Last weekend, China's Central Bank, the People’s Bank of China (PBoC) performed the largest liquidity injection to boost their depressed economy in the wake of the crippling Covid shutdowns last year. China is the world's second-largest economy and the (PBoC) is the world's third-largest central bank. In addition, the Bank of Japan (BOJ), the world’s 4th largest central bank is also injecting liquidity into the market.

While the Fed is tightening, the world's third + fourth largest central banks are easing, which is actually causing an uptick in global liquidity (after liquidity bottomed in Q4)! This could be an inflection point for global macroeconomists. Thinking of global liquidity rather than the US in isolation could prove to be more appropriate especially when analyzing crypto markets.

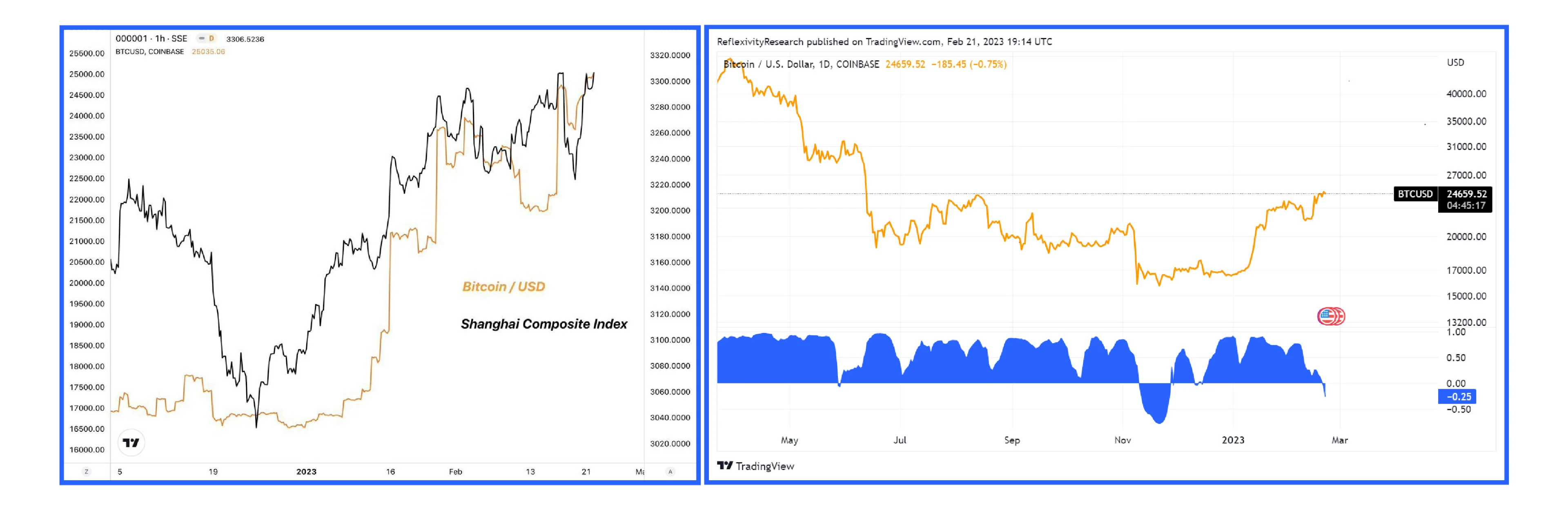

Bitcoin is the ultimate liquidity sponge. When there is liquidity in the market, BTC gobbles a lot of it and is the fastest “risk on” horse. In fact, in 9 of the last 12 years, bitcoin has been the best-performing asset class in the world. This chart below showing PBOC’s liquidity injection correlation to bitcoin price could explain the recent uptick in crypto prices.

Moreover, in February Bitcoin’s correlation with the S&P 500 flipped to the negative, while its correlation with the Shanghai Composite index is positive. Still too early to draw conclusions on Bitcoin’s correlation or lack of to the Shanghai Index or the S&P 500, but it is a sign that there’s a new player on the field.

In addition, Hong Kong has recently taken a major step towards becoming a cryptocurrency hub by outlining a plan to allow retail investors to trade digital tokens such as Bitcoin and Ether.

So, could the next bull market run from the east? You never know!