Understanding Liquidity Pools

A liquidity pool is a crowdsourced pool of funds for two crypto assets locked into a smart contract that provides liquidity to enable the trading of trading pairs on a Decentralized Exchange (DEX).

What are Liquidity Pools?

A liquidity pool is a crowdsourced pool of funds for two crypto assets locked into a smart contract that provides liquidity to enable the trading of trading pairs on a Decentralized Exchange (DEX). Liquidity pools use an Automated Market Maker (AMM) algorithm, which enables digital assets to be traded in a permissionless and trustless manner.

How do Liquidity Pools Work?

Any users or investors known as liquidity providers can provide the funds in a liquidity pool. A liquidity pool incentives and rewards liquidity providers for staking (providing liquidity) digital assets. These rewards are paid to them from the trading fees (gas fees) paid by users, and in addition, they can also be rewarded with the unique token of the protocol.

Moreover, liquidity pools use an AMM algorithm to maintain the fair price of each token relative to one another within that liquidity pool. Different liquidity pools have different algorithms, but the most popular algorithm is the Constant Product Formula. Refer to the article on AMMs to better understand how this formula works. It is used in many popular DEXs to maintain the price ratios of the tokens depending on how they may shift due to demand and supply forces. Popular liquidity pools of this algorithm include Uniswap, Curve, Balancer, Sushi-swap, and Pancake-swap.

Investing in a liquidity pool is commonly known as yield farming. Essentially, it is the process of locking up crypto assets in the Decentralized Finance (DeFi) protocol to generate tokenized rewards. Below is a step-by-step guide that illustrates how investing in a liquidity pool (Yield farming) works, for example, with Uniswap.

Go to Uniswap and connect your Ethereum wallet.

Find an ETH-USDT liquidity pool.

Deposit an equal dollar ratio (50:50) of ETH and USDT. For example, if 1 ETH is valued at $2000, then for every ETH deposited, one should deposit 2000 USDT.

Select a lock-up period for the assets.

The protocol will then provide an estimated return on investment in trading fees and UNI tokens depending on the lockup period and the amount of digital assets deposited.

Liquidity Pool Tokens

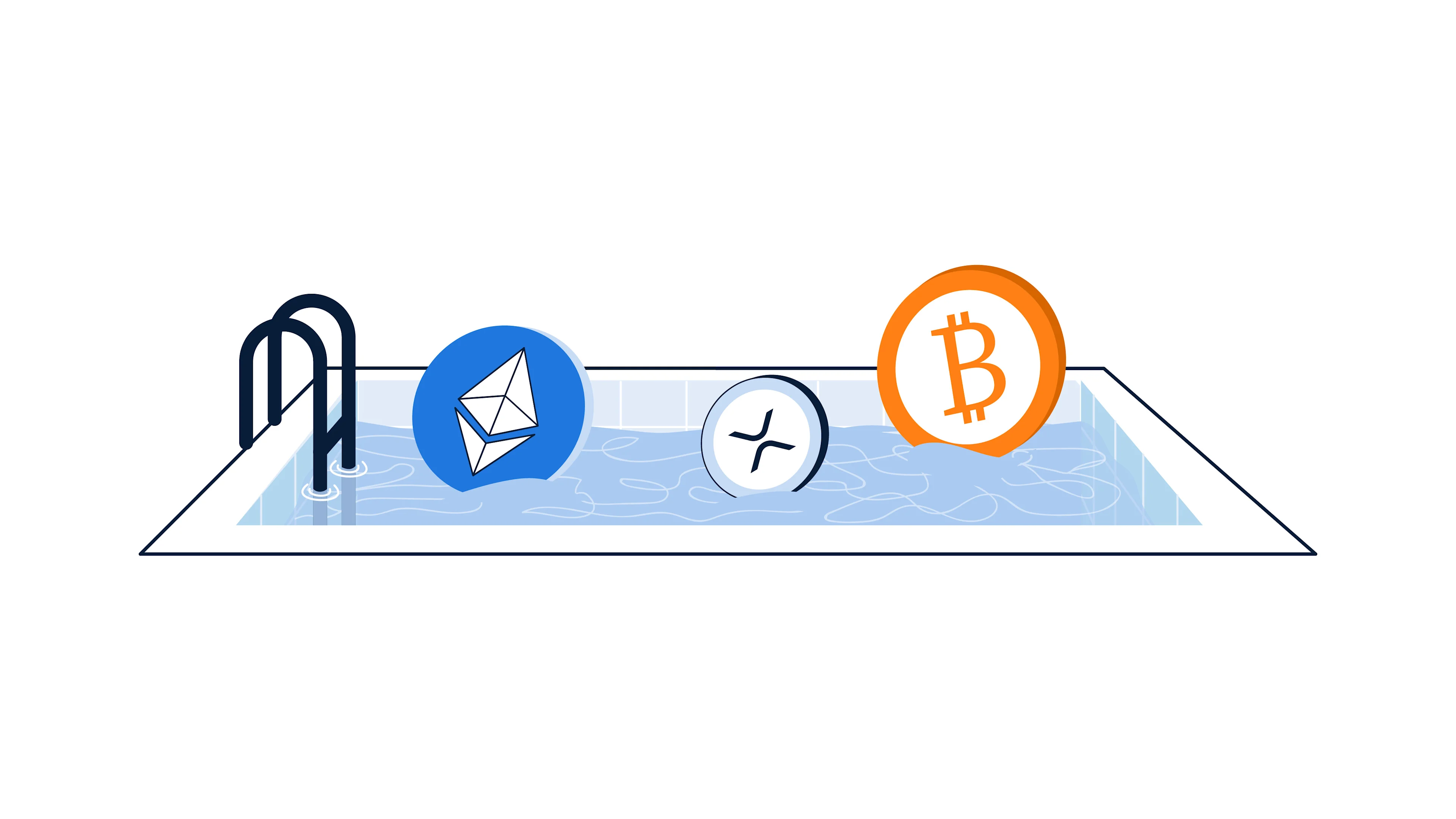

Upon depositing a pair of tokens into the liquidity pool, liquidity providers are issued liquidity tokens that act as a receipt for the deposited assets. These liquidity tokens represent one's share of the pool and will allow the owner to retrieve the deposited asset plus interest gained or other rewards.

Liquidity tokens are sent directly to the wallet that deposited the pair of assets. The tokens will come in the name of the two tokens one has provided liquidity in. For example, if a liquidity provider provides ETH and USD, then they will receive an ERC-20 token in the name of ETH-USD. Furthermore, they are only available in the DeFi ecosystem because the CeFi ecosystems usually take custody of the tokens.

Uses & limitations of liquidity Tokens