Investing vs. Trading

Investing essentially relies on a long-term approach and often applies to retirement accounts.

What is investing?

Investing essentially relies on a long-term approach and often applies to retirement accounts. Investors aim to gradually build wealth by growing their portfolios over the years and decades to come. Investors are more concerned about the intrinsic value (obtained through fundamental analysis) of their assets rather than short-term price movements. They believe that spending more time in the market is the most profitable strategy rather than trying to time market pumps and dumps.

Types of investors

Active vs. Passive management

Active investors tend to be more involved with their investments or portfolios by Doing Their own Research (DYOR), selecting the assets they want to invest in, and buying & selling themselves rather than relying on a third party (broker), etc.

Alternatively, passive investors mainly rely on pools of assets (stocks, commodities, etc.), REITS, or ETFs to make their investments rather than rely on brokers or a third party to manage their investments. This allows them to sit back and not worry about what their portfolios look like on a regular basis.

Due to the novel and low regulation of the cryptocurrency market, there are very few passive investment options, such as ETFs and trust; thus, most investors in the cryptocurrency market are active investors.

What is trading?

Trading is the frequent buying and selling of assets to generate profitable returns that would outperform holding an investment for a long time. Traders are able to take advantage of short-term or long-term pumps or even price dumps by shorting the market. Traders mainly rely on technical analysis to speculate on the market and make profitable decisions. They adhere to a strategy of timing the market to reap the most profits and avoid making losses rather than spending more time in the market.

Types of traders

Swing traders: sometimes also referred to as momentum traders, execute a trade based on the markets or asset's current trend. They work with much longer timeframes, that is, from several days to weeks. Momentum traders rely on a fair amount of technical analysis to estimate good entry and exit positions. Moreover, they rely on some fundamental analysis to estimate how the momentum of the current trend may be affected in the short term, usually relying on current news or upcoming developments.

Day traders: These are traders that do not hold assets for make than a day or overnight. They frequently watch the markets and do technical analysis to find the best entry and exit positions, not necessarily concerned about the current trend. Their trade periods range from minutes to hours.

Scalp traders: These are the most active tradersthat try to profit from small price fluctuations and often rely on leverage trading to multiply the small price change into large profits. Scalpers mainly rely on the seconds to minute time frames which require maximum concentration, speed, and exceptional technical analysis skills.

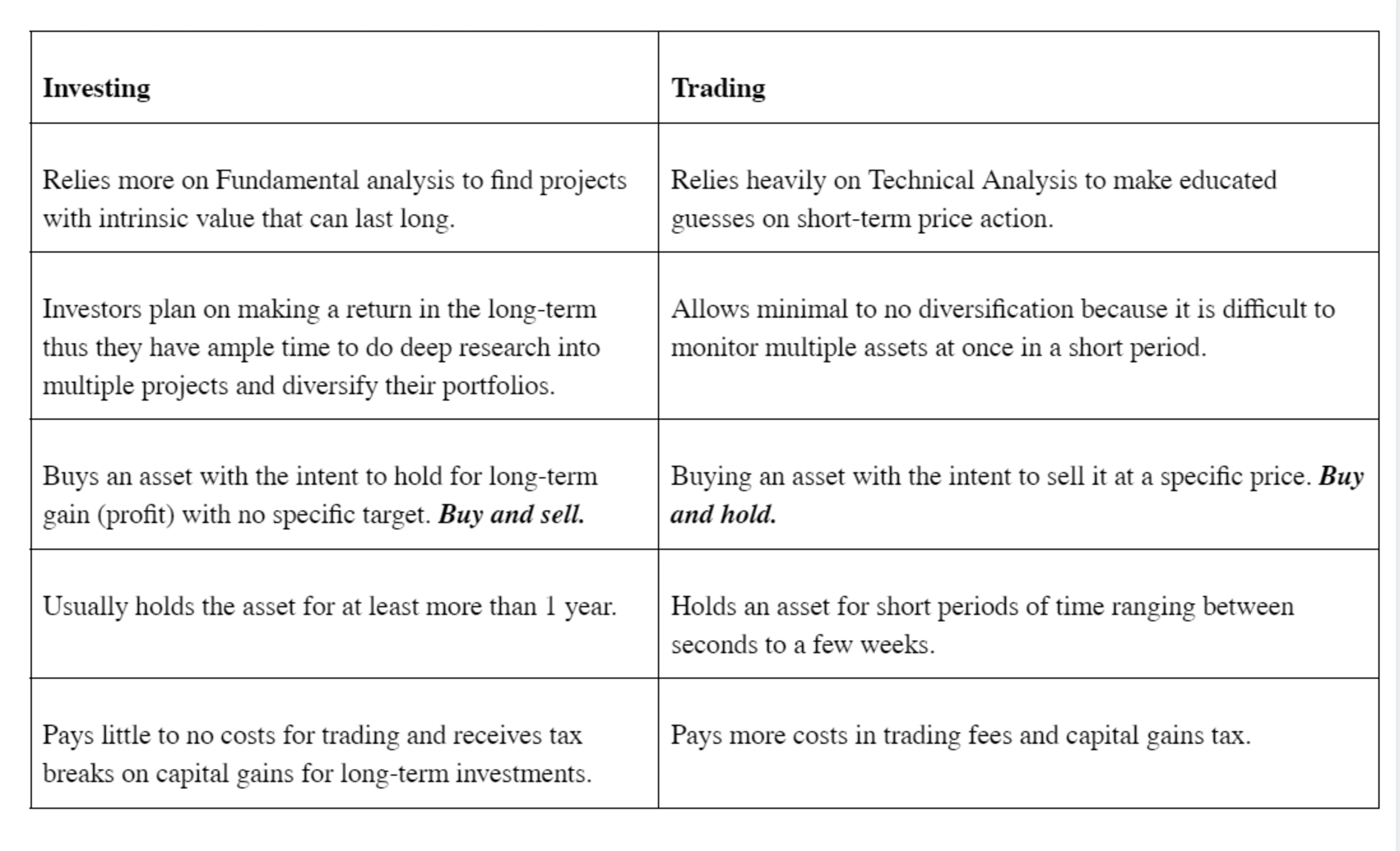

Investing vs. Trading

The critical difference between investing and trading is the time period that one holds the asset. Investors are usually in it for the long term, while traders seek to take advantage of short-term price fluctuations. Below is a more detailed outline of the differences between investing and trading.

Cryptocurrency Trading vs. Investing

The cryptocurrency market is still a relatively new asset class; thus, these “legacy” disciplines of investing and trading that existed before cryptocurrencies are, to some extent, applicable. One of the major differences is that crypto markets are relatively new. They are quite volatile. Consequently, there are a few ways that cryptocurrency and legacy investing or trading may differ.

Purchasing a cryptocurrency does not give you ownership of the project or “company” as one would own when purchasing a stock or share of a company. Rather, it is a coin or token that is used as a currency on the given network.

Moreover, it is much easier to purchase cryptocurrencies because of the little to no regulation around the world. The reduction of this regulatory hurdle makes it easier, faster, and less complex to access cryptocurrencies.

At the same time, having little to no regulation poses a regulatory risk to consumers and developers.

Essentially, the basic concepts of trading and investing apply to cryptocurrency, and given that it is a new asset class and technology, it has introduced its own new investment and trading strategies.

Given that it is a new technology and asset class, there are those who believe in the long-term potential of blockchain technology and digital assets; thus, they have opted to ignore the volatility and noise. These are long-term investors in the space who often reference the term “Hodl” to emphasize the importance of investing in cryptocurrencies, digital assets, and blockchain technology.

On the other hand, the crypto-markets are quite volatile because it is a new investment vehicle, thus not widely adopted, and have a relatively small market capitalization relative to other financial markets. The high volatility of the crypto market has rather presented itself as the perfect opportunity for traders to reap higher profits in the short term but with more risk.