Understanding Arbitrage Trading

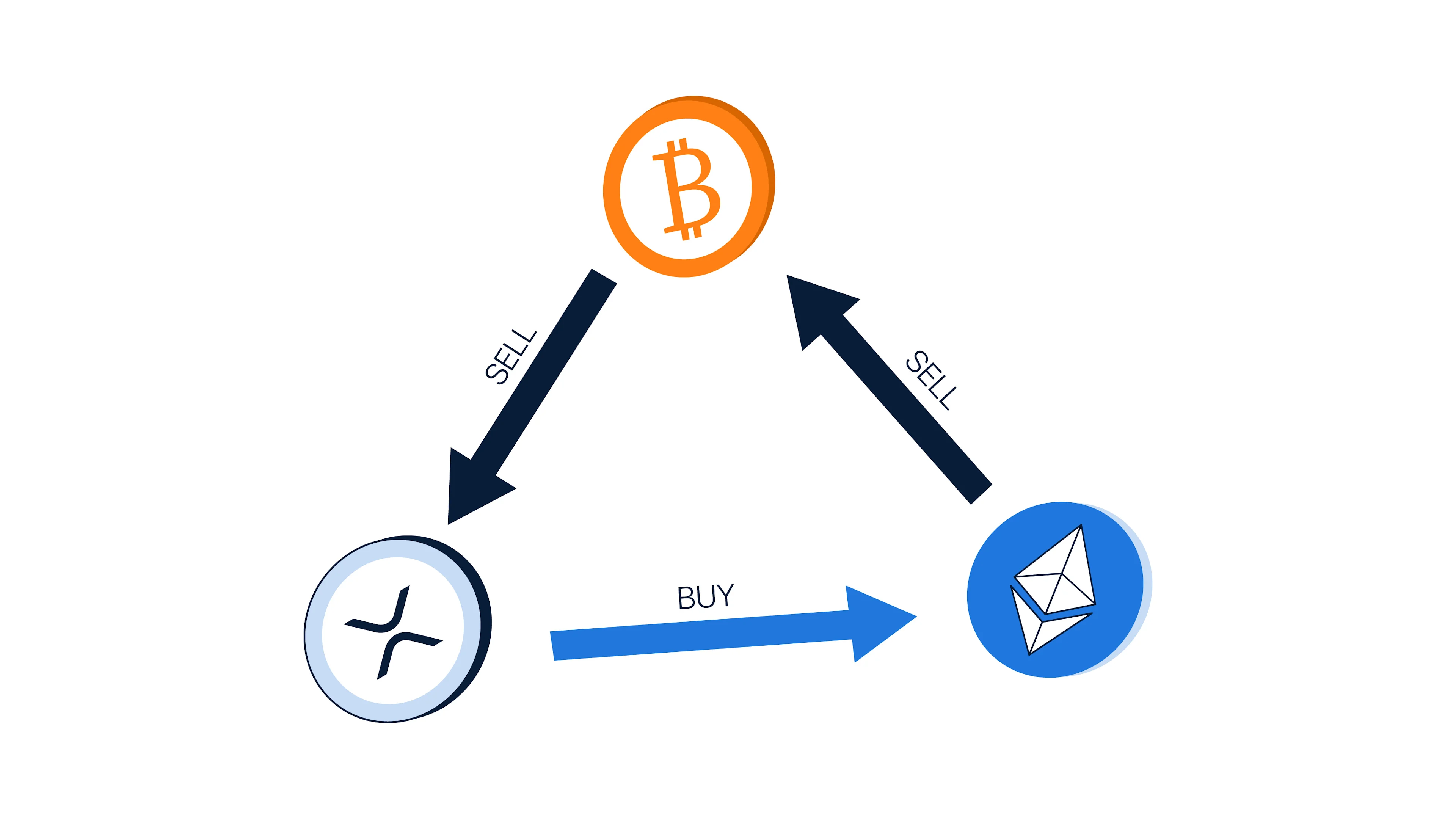

Arbitrage trading is a trading strategy in which traders aim to benefit from the price difference of an asset between different markets (exchanges).

What is Arbitrage Trading?

Arbitrage trading is a trading strategy in which traders aim to benefit from the price difference of an asset between different markets (exchanges). Essentially, arbitrageurs attempt to generate profit by buying an asset at a lower price in one market and then selling it for a higher price in another market.

How does arbitrage trading work (how does it happen; Why Are Prices Not Fixed Across Crypto Exchanges?)

Ironically, arbitrage opportunities are caused by a low correlation of prices in different exchanges, which is indicative of market inefficiencies. Hence, arbitrage trading establishes a symbiotic relationship between arbitrageurs and markets. Arbitrageurs can make a profit from arbitrage trades while helping markets become more efficient by trading until there is no profitable arbitrage opportunity; at this point, price differences in different exchanges have been balanced out.

Arbitrage trading is almost a “guaranteed” profitable trade because you are aware of where to sell it for profit. Although it is simultaneously difficult because the trade needs to be aware of which assets and in which market they can find a profitable arbitrage opportunity. Moreover, arbitrage traders need to be able to trade quickly before the difference disappears or the opportunity is taken up by other traders.

Arbitrage opportunities a more common in crypto markets because it is a niche market and has high price volatility. Furthermore, cryptocurrencies are assets not limited by jurisdiction; thus, there are multiple exchanges with varying trade volumes across the world which increases the potential for arbitrage opportunities.

Arbitrage trading risks

Arbitrage trading is generally considered to be a low-risk opportunity, although there are a few things to take note of before becoming arbitrageurs, even more specifically in crypto markets.

Execution risk: The biggest risk in arbitrage trading is for the price difference to disappear after buying an asset but before you can sell it for profit. As explained before, arbitrageurs need to be able to act quickly when trying to capitalize on arbitrage trades. Furthermore, given the volatility of crypto markets, slippage risk is much higher, and arbitrageurs should take note of this before executing a trade.

Transaction fees: arbitrageurs usually attempt to profit on the smallest price differences; thus, the profit margin is usually quite small. With this in mind, it is important to factor in transaction fees when calculating the potential profits before executing a trade.

Wallet security: This is a general risk associated with holding any crypto assets. Although, there are exit scams that specifically targeted traders. Essentially, the developers can abruptly halt operation for any given reason, which would limit one’s ability to react quickly to an arbitrage opportunity.