Crypto Lending (Part 1)

Crypto lending is the process of taking the crypto of one user and providing it to another user (the borrow) for a fee (interest rate).

What is Crypto lending?

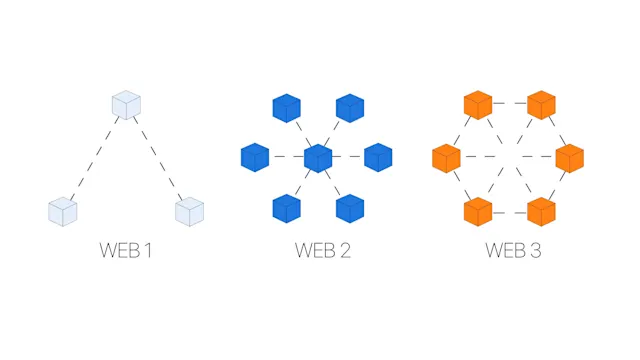

Crypto lending is the process of taking the crypto of one user and providing it to another user (the borrower) for a fee (interest rate). Lending services for crypto are available through both centralized and decentralized platforms. Crypto lending, more specifically Decentralized Finance (DeFi), is initiated by smart contracts.

How does it work?

There are usually three parties involved in the lending process. The lender, the borrower, and the centralized or decentralized platform facilitating the service. With most types of loans, the borrower is required to put up collateral for the loan they take, and the platform calculates the fees to be paid (interest rate) plus the collateral needed (usually up to 150% to 200% of the amount borrowed). Moreover, some platforms enable users to earn interest on their collateral which will help to pay back the loan and interest (sort of lending their collateral to the protocol). The lender puts their cryptocurrency into a pool managed by the platform, and the platform calculates the fees to be earned (APY or APR) to be paid to the lender. A decentralized platform that completely runs smart contracts facilitates the transaction between the borrower and the lender.

Types of lending platforms

CeFi lending

CeFi or centralized finance platforms act as an intermediary for lending services. They are the equivalent of banks for crypto services such as lending but with a bit less regulation. The centralized platforms take custody of the deposited funds (lent into a staking pool or collateral). Additionally, all centralized platforms require users to create an account which includes KYC requirements, therefore excluding anonymity. Even though users have to give up their identity, CeFi can protect crypto assets through insurance schemes or by storing the crypto in cold wallets.

Moreover, CeFi platforms still use blockchain technology which provides the inherent advantage of a fully transparent system because all transactions are recorded on a public ledger. Even though there is more paperwork involved in CeFi than DeFi, the advantage of a more regulated and secure environment makes it more appealing to traditional investors. The most prominent CeFi lending ecosystem includes BlockFi, Celsius, Binance, and Nexo.

DeFi lending

DeFi platforms present a completely decentralized and automated way of providing lending services. Lending transactions are automated by pre-coded smart contract algorithms. DeFi platform is more accessible to the general public because it does have any KYC or registration procedures to use the service; one only needs a digital wallet and internet access. However, using a DeFi platform requires a level of understanding of crypto and blockchain technology to navigate it, making it unusable to many novice investors. Some of the most prominent DeFi lending platforms include Aave, Compound, and dYdX.

Types of loan

Flash loans

A flash loan is a type of uncollateralized debt that is available only on DeFi platforms. As with any DeFi transaction (including lending), flash loans are automated by smart contracts with the condition that the borrowed amount plus interest must be paid back within the same transaction block. If this condition is not met, the transaction would fail; that is why there is no need to put up collateral. Flash loans are mainly used to exploit arbitrage opportunities and for collateral swaps.

Collateralized loans

Collateralized loans give borrowers more time to pay back the loan. In a highly volatile crypto market, users are only able to borrow up to 50% of the collateral provided; this enables some moving room in case the collateral loses its value due to market conditions. If the collateral falls below a certain threshold, the collateral will be liquidated. Loans can be provided in stablecoins or cryptocurrencies such as BTC or ETH.