Kalam Crypto #142: DeepSeek Disruption & Major Crypto Wins in Jordan & USA

Ahlan wa sahlan, and welcome to the 142nd edition of CoinMENA’s weekly newsletter, Kalam Crypto!

“DeepSeek R1 is AI’s Sputnik moment” Marc Andreessen

Ahlan wa sahlan, and welcome to the 142nd edition of CoinMENA’s weekly newsletter, Kalam Crypto!

This week marked a pivotal moment for crypto, with groundbreaking political and regulatory moves both regionally (Jordan) and globally (U.S.) signaling a shift toward broader adoption and innovation. From key leadership changes to relaxed banking rules, the stage is set for a new chapter in the digital asset revolution. Meanwhile, DeepSeek's disruptive entrance into the tech market sent shockwaves, causing tech stocks to plummet. Yet, amidst the turmoil, Bitcoin stood firm, showcasing its resilience and further solidifying its properties as a risk-off asset. The future of crypto has never looked brighter. Let’s dive into this week’s edition of Kalam Crypto!

Local News 📍

🇯🇴Jordan To Establish Regulatory Framework for Virtual Assets: In a significant move to align with global standards and boost its digital economy, Jordan's Cabinet has approved the establishment of a comprehensive regulatory framework for virtual and digital assets. The Jordan Securities Commission and a ministerial committee will oversee the implementation, ensuring compliance with international standards and safeguarding investor interests. This framework not only enhances Jordan's competitiveness in global markets but also positions it as a leader in the regional FinTech landscape. At CoinMENA, we are very excited about this development and look forward to launching our services to new markets, further contributing to the growth of the digital economy in Jordan and beyond.

Global News 🌍

Trump Signs Executive Order to Make the U.S. the Crypto Capital of the World President Trump, flanked by AI and crypto czar David Sacks, signed an executive order aiming to position the U.S. as the global leader in crypto. The order emphasizes protecting self-custody and mining rights, bans federal agencies from issuing a central bank digital currency (CBDC), and establishes a Working Group on Digital Asset Markets chaired by Sacks. The group will propose a federal framework for digital assets and explore creating a strategic digital asset stockpile, though not a Bitcoin stockpile, at least for now.

SEC Revokes SAB-121, Clearing Path for Banks to Embrace Bitcoin The SEC rescinded its controversial SAB-121 rule, replacing it with SAB-122, which allows banks to decide whether to report held digital assets as liabilities. This change removes a major barrier for financial institutions looking to offer Bitcoin and crypto services. Additionally, Senator Cynthia Lummis, a vocal Bitcoin advocate, was appointed chair of the Senate Banking Subcommittee on Digital Assets, signaling growing political support for crypto.

Gary Gensler Steps Down as SEC Chairman, Mark Uyeda Takes Interim Role Gary Gensler has resigned as SEC Chairman, with Mark Uyeda stepping in as interim chair. President Trump plans to nominate former SEC Commissioner Paul Atkins to lead the agency, pending Senate confirmation. Gensler’s departure marks a potential shift in the SEC’s approach to crypto regulation, as Atkins is seen as more industry-friendly.

Pro-Crypto Scott Bessent Confirmed as Treasury Secretary The Senate confirmed Scott Bessent as Treasury Secretary in a 68-29 vote, solidifying a crypto-friendly voice in the administration. Bessent, a billionaire former hedge fund manager, will join a working group to develop a federal regulatory framework for digital assets and evaluate a "strategic national digital assets stockpile." A vocal opponent of CBDCs, Bessent has long championed crypto as a tool for financial freedom.

Keep an eye on 👀

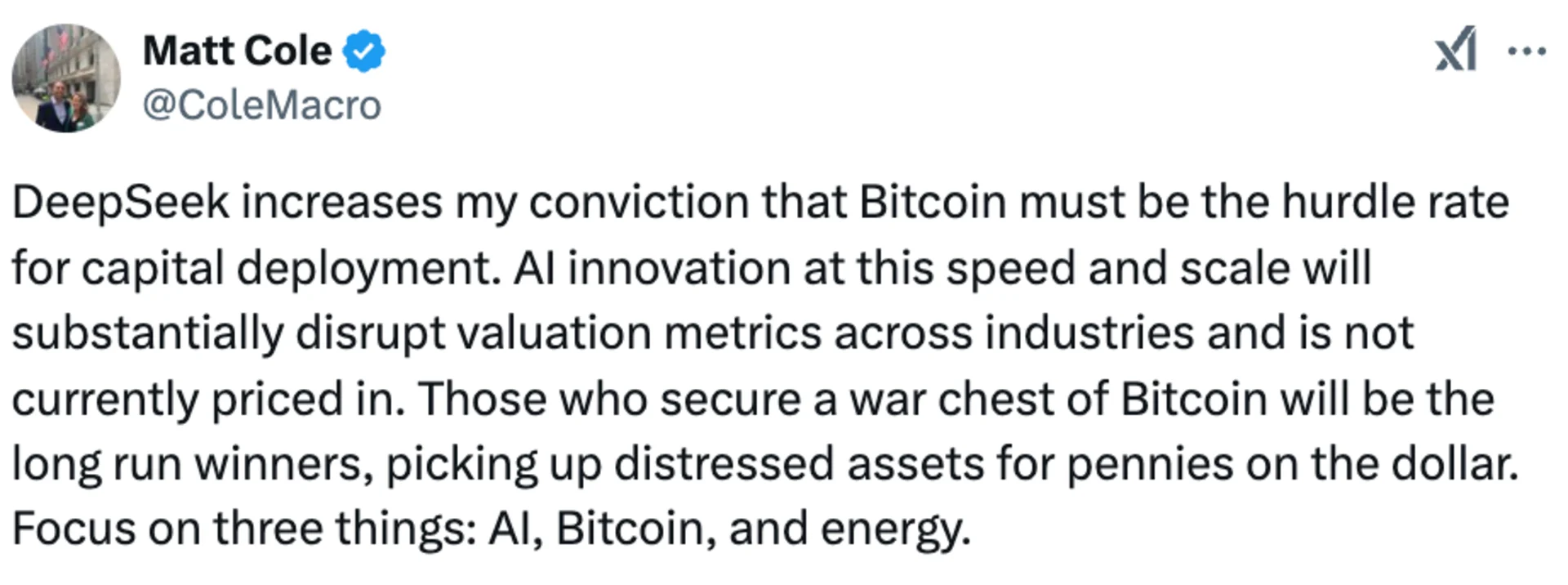

DeepSeek AI Shakes Up Tech, Bitcoin Stands Apart: DeepSeek AI made waves this week with a breakthrough model that outperforms ChatGPT at a fraction of the cost, challenging the notion that China can’t compete in software. The numbers are jaw-dropping: training costs dropped from $100 million to $5 million, GPUs needed fell from 100,000 to 2,000, and API costs are now 95% cheaper. This sent tech stocks, especially chipmakers like Nvidia, into a historic nosedive. For Bitcoin, this highlights a key distinction: while tech is vulnerable to disruption, Bitcoin’s predictability, immutability, and decentralization make it uniquely resilient. Could this be the start of Bitcoin shedding its "risk-on" label? Time will tell.

Blog of The Week ✍️

CoinMENA Co-founders Talal Tabbaa and Dina Sam’an, proud Jordanians, shared their insights on the positive regulatory news from Jordan. Check out their blog posts to learn more.

Tweet Of The Week 🐥

CoinMENA News 🗞️

🎉 $1,000 XRP Giveaway: Trade with $15 or more and qualify to be one of 5 winners to earn $200 in XRP each! This giveaway ends on January 31st, 2025. The more you trade, the closer you are to winning!

Quiz Corner ✅

Last week’s question: What are meme coins? The correct answer is B) digital coins created as a joke.

This week’s question, What is the main objective of President Trump's executive order regarding cryptocurrency?

A) To ban the use of cryptocurrencies in the U.S.

B) To position the U.S. as the global leader in crypto

C) To create a federal digital currency for the U.S.

D) To regulate Bitcoin mining globally

See the answer in next week’s newsletter. Or check out our learning platform https://university.coinmena.com/

Invest in the future of finance today with CoinMENA

Related Articles

Kalam Crypto #146: Trump Announces U.S. Crypto Reserve

Kalam Crypto 144:Tether’s Big UAE Move, Inflation in US/UK, CoinMENA’s Viral Ad!

Kalam Crypto #143: Trump Tariff Wars, Bitcoin Impact, USDT Launches on Lightning