Kalam Crypto #121: ETH ETF Approved!

This week, the ETH ETF gets approved and trading will commence immediately. There are also rumors of the U.S. adopting bitcoin as a treasury reserve asset, and CoinMENA has released a new feature allowing users to send USDT via Tron with zero fees!

“The willingness to change one’s mind in the light of new evidence is a sign of rationality not weakness.” Stuart Sutherland

Ahlan wa sahlan, and welcome to the 121st edition of CoinMENA's weekly newsletter, Kalam Crypto. This week, the ETH ETF gets approved and trading will commence immediately, potentially unlocking large pools of capital to invest in ETH. There are also rumors of the U.S. adopting bitcoin as a treasury reserve asset, Bitcoin ETF flows continue to increase, and CoinMENA has released a new feature allowing users to send USDT via Tron with zero fees! All that and more in this week’s Kalam Crypto.

Global News 🌍

ETH ETF Approved: The U.S. Securities and Exchange Commission (SEC) has approved the first spot Ethereum (ETH) exchange-traded funds (ETFs), with trading set to begin today (July 23, 2024). This marks a significant milestone for the crypto industry, allowing investors to trade Ethereum directly on major exchanges like Nasdaq, NYSE, and the Chicago Board Options Exchange. Major financial institutions such as Grayscale, Fidelity, and Bitwise are among the issuers of these new ETFs. The approval is expected to unlock large pools of capital to invest in the world’s second-largest cryptocurrency.

U.S. adopting bitcoin as a reserve asset? Nothing moves as fast as crypto markets. The idea of the U.S. adopting bitcoin as a reserve asset was unthinkable just a week ago. Since then, BlackRock CEO Larry Fink has called bitcoin a legitimate financial asset that everyone should hold. Former President and current presidential front-runner Donald Trump is considering JPMorgan CEO Jamie Dimon for Treasury Secretary, noting Dimon has "changed his mind on bitcoin." A CNBC segment this week discussed the potential impact of adding bitcoin to the U.S. Treasury. Trump is set to headline the bitcoin conference in Nashville this week, where rumors suggest he will make a significant announcement. Stay tuned!

Keep an eye on 👀

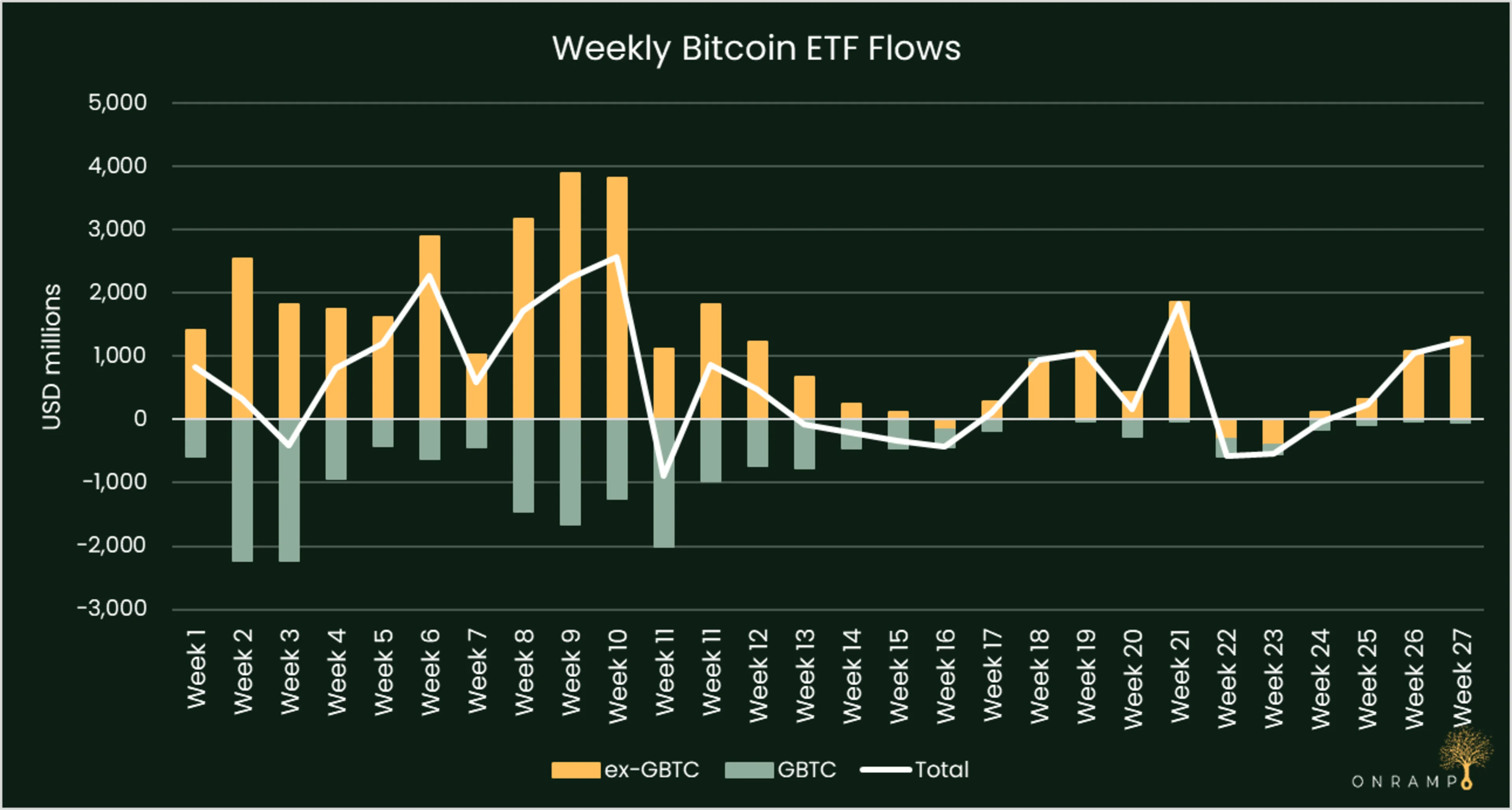

Bitcoin ETFs flows accelerating: Last week saw a significant increase in bitcoin ETF inflows, with a total intake of $1.24 billion, equivalent to over 19,000 BTC. Following the German government's sale of 50,000 seized bitcoins, the Mt. Gox bankruptcy trustee transferred 48,600 bitcoins to Kraken for creditor distribution, expected to occur over the next one to two weeks. It is anticipated that less than 50% of the 48,600 BTC will be sold. However, given the recent pace of 18,600 BTC per week in ETF inflows, it would take approximately 2.5 weeks for these flows to absorb the entire initial distribution of Mt. Gox coins.

CoinMENA News 🗞️

🚨New Feature Alert: Free USDT Withdrawals via Tron! Yes! You read that correctly. You can now withdraw (send) #USDT via #Tron’s TRC-20 anywhere in the world and pay ZERO fees! This special offer won’t last forever, so take advantage of it while it lasts! Read more about this offer here: https://www.coinmena.com/en/blog/3op9CEregyrmb7LuQdLqgB

Tweet Of The Week 🐥

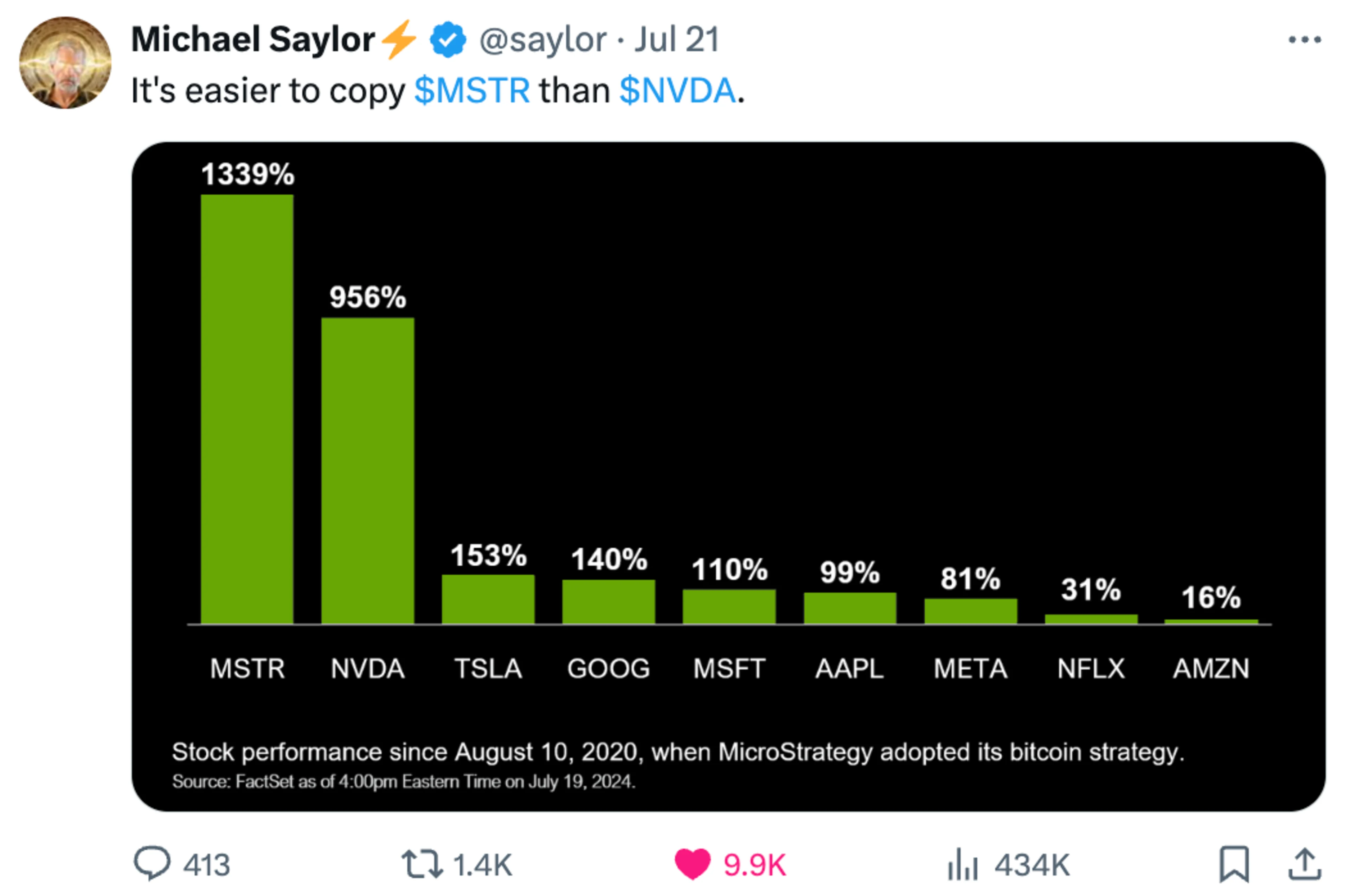

MicroStrategy is the only company to outperform Nvidia since the adoption of bitcoin as a treasury reserve asset in August 2020.

Quiz Corner ✅

Last week’s question: Which government recently began selling off a significant portion of their Bitcoin holdings, causing market fluctuations? The correct answer is B) Germany, in what will likely go down in infamy as one of the worst investment decisions of all time.

This week’s question is, how many crypto ETFs have been approved this year?

a) 1 b) 2 c) 3 d) 4

See the answer in next week’s newsletter. Or check out our new learning platform https://university.coinmena.com/