Fed Pivot & Fiscal Dominance

What the Fed Pivot might mean for the economy, stocks, and bitcoin

You can read and download the full report here.

In This Week's Roundup:

• What the Fed Pivot might mean for the economy, stocks, and bitcoin

Fed (Finally) Pivots

"The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on the incoming data, the evolving outlook, and the balance of risks."

That was the quote during Jerome Powell's speech last Friday at Jackson Hole that all but guaranteed the beginning of a rate cutting cycle in September and sparked a broad-based asset rally, including bitcoin which rose 7.5% on the remarks up to $65k.

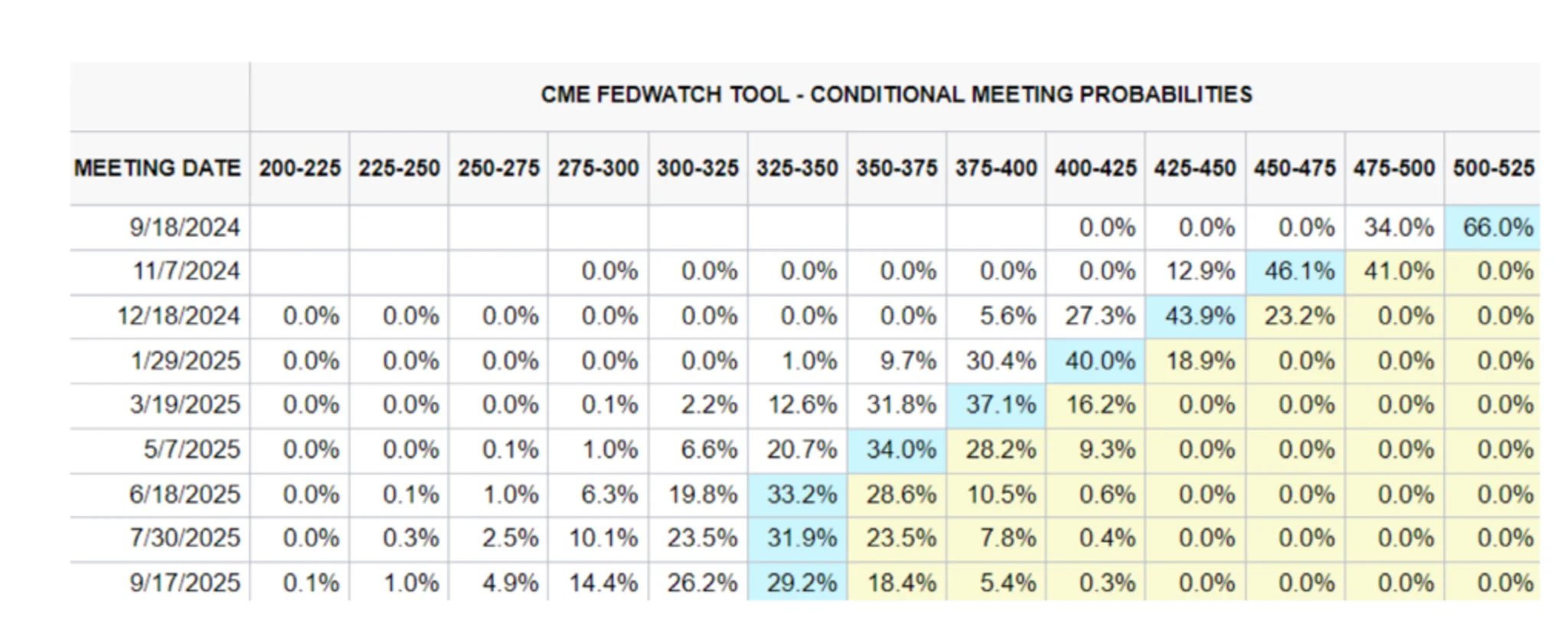

Fed funds futures are now pricing in a 100% chance of a rate cut at the Fed's September meeting, with a 66% chance of 25 bps and a 34% chance of 50 bps:

source: CME Fed Watch

Of course, the market has been over-zealous in pricing in rate cuts since the last "Powell Pivot," which we wrote about all the way back in December of last year.

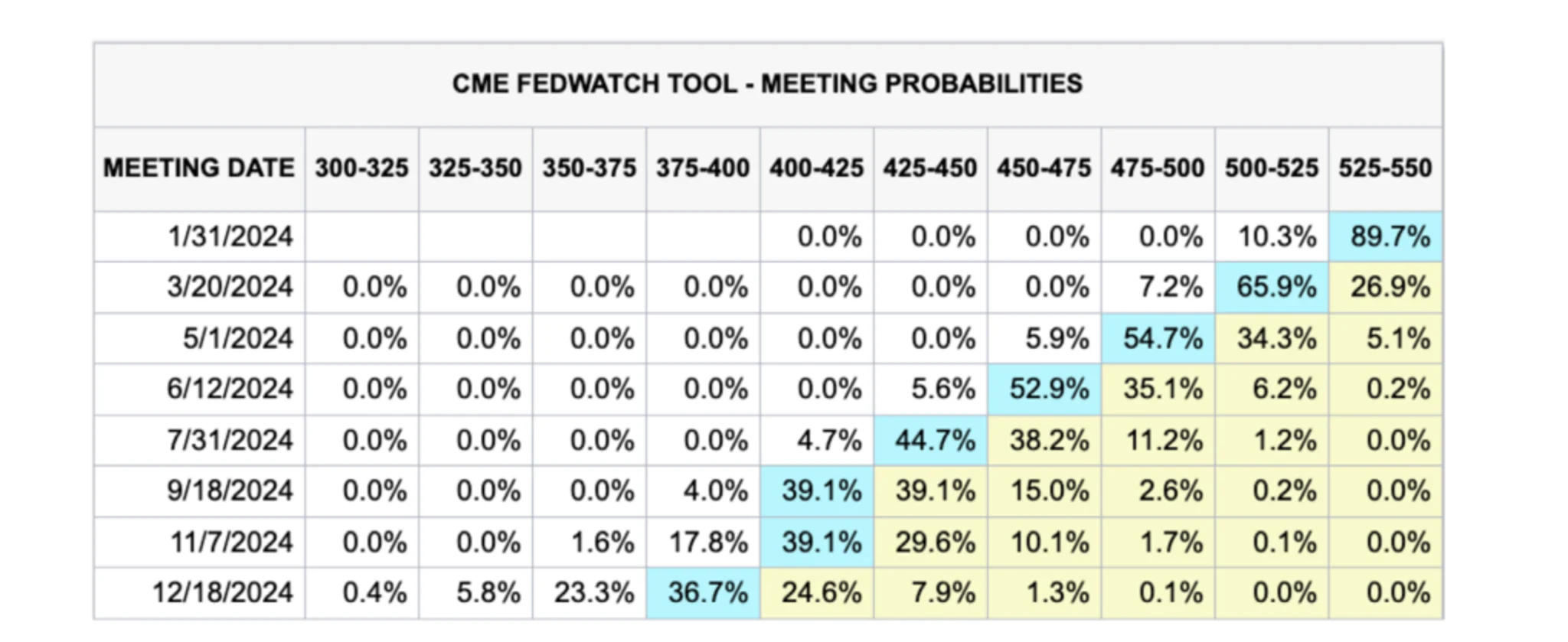

Sometimes it's fun, and insightful, to go back in time and see what the market was saying. Here is what that same forecast looked like after the Fed's December 2023 meeting, when Powell first suggested cuts may be on the table

You can read and download the full report here.