Kalam Crypto #132: Bitcoin is the 6th largest monetary asset in the world!

This week, Bitcoin has become the 6th largest monetary asset in the world, the European Central Bank released a paper with an intriguing perspective on Bitcoin, CoinMENA added two highly anticipated digital assets (PEPE & WIF).

“Behind every great achievement lies a long, unseen journey.”

Ahlan wa sahlan, and welcome to the 132nd edition of CoinMENA’s weekly newsletter, Kalam Crypto! This week, Bitcoin has become the 6th largest monetary asset in the world, the European Central Bank released a paper with an intriguing perspective on Bitcoin, CoinMENA added two highly anticipated digital assets (PEPE & WIF), and Bitcoin ETF inflows continue to rise. All this and more in this week's edition of Kalam Crypto!

Global News 🌍

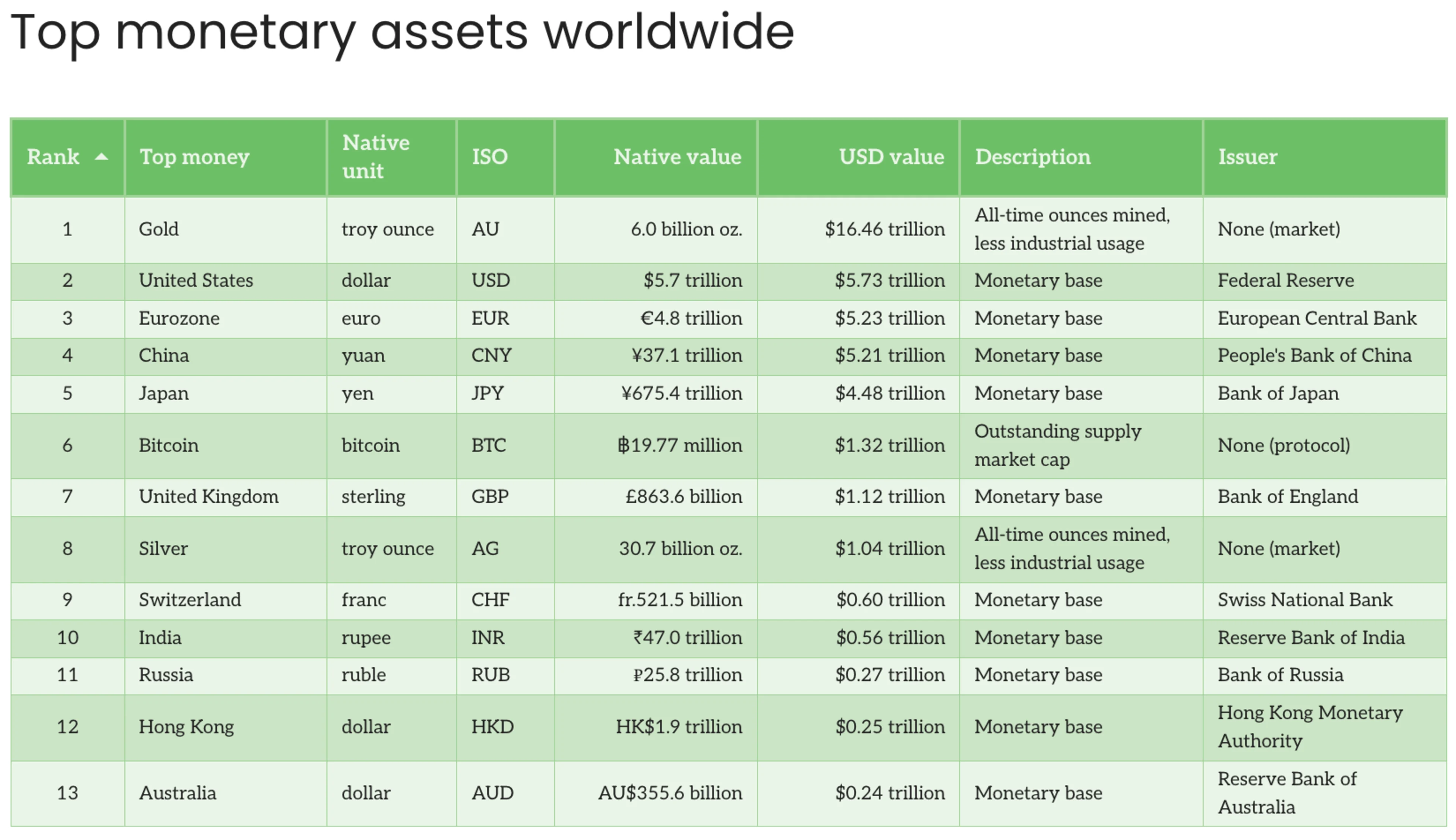

Despite ongoing skepticism about Bitcoin's utility and value in 2024, it has risen to become the 6th largest monetary asset globally, surpassing the British pound and trailing only gold, the US dollar, the euro, the yuan, and the yen.

ECB Admits Defeat on Bitcoin? European Central Bank economists Ulrich Bindseil and Jürgen Schaaf published a paper titled "The Distributional Consequences of Bitcoin," warning that sustained Bitcoin price increases could create wealth disparities. According to the paper, early Bitcoin adopters would benefit significantly, while non-holders and those entering the market late may face financial disadvantages.

CoinMENA’s take: Yes, we agree.

Tweet Of The Week 🐥

In related news, this tweet perfectly sums up our reaction to the ECB’s paper.

CoinMENA News 🗞️

Two New Digital Assets: 🐸PEPE & 🐶WIF

We’re excited to announce the addition of two highly requested digital assets to our platform: PEPE and WIF. Both meme coins have seen significant gains this year, with PEPE delivering over 600% returns and WIF over 1,000% year to date. Users can now diversify their portfolios with these popular assets. However, meme coins are inherently volatile, and past performance is not indicative of future results.

Zero Trading Fees Uptober Celebration: In the crypto world, October is often called “Uptober” because historically, crypto prices tend to rise. To celebrate, we’re offering zero trading fees for the entire month of October! Take advantage of zero fees and enjoy the best crypto-to-fiat rates in the market.

Keep an eye on 👀

BTC ETF Flows Surging: The spot Bitcoin ETF market saw a surge in inflows last week, with total inflows reaching $555.9 million on October 14, the highest since July. Fidelity's Wise Origin Bitcoin Fund led with $239.3 million in inflows, followed by Bitwise Bitcoin ETF Trust with $100.2 million, and BlackRock's iShares Bitcoin Trust, which attracted $79.5 million on Monday and over a billion throughout the week. This inflow surge aligns with Bitcoin's price increase from $60,770 to $67,690, pushing total assets under management (AUM) for spot Bitcoin ETFs to a record $63.8 billion, reflecting growing interest from both retail and institutional investors. Market analysts attribute this trend to favorable macroeconomic conditions, including lower global interest rates.

Quiz Corner ✅

Last week’s question: According to the Crypto Information Sharing and Analysis Center (ISAC), which of the following is the dominant means of criminal activities globally? The correct answer is C, Cash.

This week’s question is, What does an increase in Bitcoin's hashrate primarily indicate?

A) Higher Bitcoin transaction fees B) Increased security of the Bitcoin network C) Reduced Bitcoin supply D) Faster Bitcoin block production time

See the answer in next week’s newsletter. Or check out our new learning platform https://university.coinmena.com/

Invest in the future of finance today with CoinMENA

Related Articles

Kalam Cypto #138: $100K Bitcoin Milestone + The Bitcoin World Comes to Abu Dhabi

Kalam Cypto #137: Corporate Bitcoin Adoption Accelerating

Kalam Cypto #136: Bitcoin Surpasses Aramco, Now 7th Largest Global Asset