Kalam Crypto #120: Germany sells their bitcoin & ETFs buy the dip

This week, the German government sold a significant portion of its bitcoin holdings, much to the dismay of one of its members of parliament. ETFs were unfazed by their first 20%+ BTC market downturn and bought the dip.

"Very few people build wealth by trying to catch every twist and turn of the market. Focus on long-term trends." Lyn Alden

Ahlan wa sahlan, and welcome to the 120th edition of CoinMENA's weekly newsletter, Kalam Crypto. This week, the German government sold a significant portion of its bitcoin holdings, much to the dismay of one of its members of parliament. ETFs were unfazed by their first 20%+ BTC market downturn and bought the dip. Our blog of the week highlights the positive impact that adopting bitcoin as a treasury reserve asset could have on a company’s stock performance. All that and more in this week’s Kalam Crypto.

Global News 🌍

German government selling Bitcoin: The German government continues selling off its bitcoin, causing Bitcoin's price to fall as low as $55,000 before recovering. According to Arkham Intelligence, Germany transferred 16,309 BTC worth over $900 million to various crypto exchanges and market makers, reducing its total holdings to 23,788 BTC from an initial 50,000 BTC. Not all members of parliament agree with this decision. German MP Joana Cotar has urged the government to stop its "hasty" Bitcoin sell-off, arguing it is neither sensible nor productive. She suggests that Bitcoin could be used to diversify treasury assets, protect against inflation and currency devaluation, and promote innovation. Cotar wrote to members of the government on July 4, advocating for Bitcoin to be adopted as a strategic reserve currency to mitigate risks in the traditional financial system.

Keep an eye on 👀

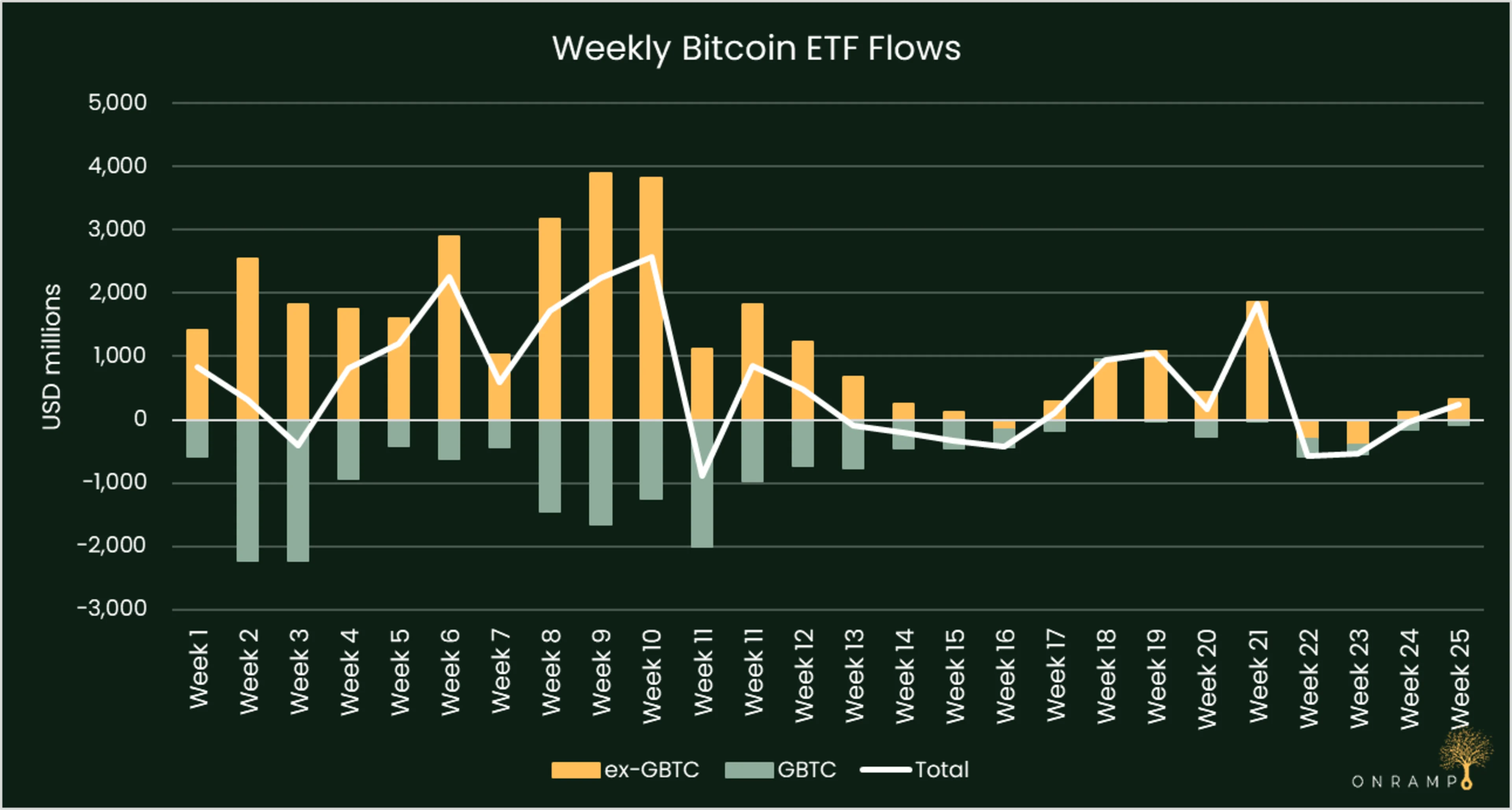

Bitcoin ETFs bought the dip: During the holiday week, Bitcoin ETF investors bought the dip, with the ETF complex experiencing $238 million in inflows despite Bitcoin's price hitting new lows since its all-time high of $73.8k in March. On the evening of July 4, Bitcoin's price reached a low of $53.5k, a 28% drawdown from its peak. This inflow amid falling prices marks a divergence between flows and price for the first time in the ETFs' short trading history. Contrary to expectations of retail-heavy ETFs experiencing panicked outflows during significant price drops, investors have continued to buy in over the past week.

Blog of The Week ✍️

This week’s blog highlights the positive impact that adopting Bitcoin as a treasury reserve asset can have on a company’s stock performance. Discover how this strategic decision can boost stock value and achieve sustainable growth. Read more here: https://www.coinmena.com/en/blog/3b22HvxXeeaeormpbNWIgC

Tweet Of The Week 🐥

German MP urging her government to not swap scarce BTC for fiat they can infinitely print.

Quiz Corner ✅

Last week’s question: Which of the following describes a “crab market”? The correct answer is C) A market with no clear trend.

This week’s question is, Which government recently began selling off a significant portion of their Bitcoin holdings, causing market fluctuations?

a) United States b) Germany c) Japan d) Canada

See the answer in next week’s newsletter. Or check out our new learning platform https://university.coinmena.com/